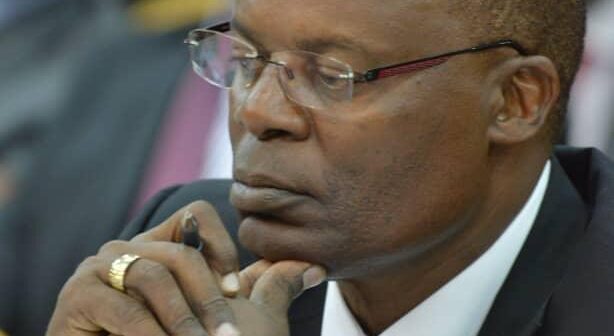

Kasekende, as you read this, has 10 days in office, but President Yoweri Museveni, who is always prompt when it comes to such important matters of the state, has not showed any interest in the matter.

No one can be deceived he is not thinking about the developments at Bank of Uganda, and whether to retain Kasekende or show him exit especially at a time when Mr. Museveni, a master strategist, is in no hurry to renew Kasekende’s expiring contract.

However, throughout the years, Museveni has shown admiration for Balunywa, praising him as a person that has always been on the right side of the liberation ideology.

Prof. Balunywa has been credited with having revolutionized business education and spearheading the private students’ scheme in Uganda that has become a model for many universities across the country and region.

Prof. Balunywa started his academic career as lecturer in 1983, in the then Department of Commerce at Makerere University. In 1987, he was appointed a senior lecturer in the Department of Accounting, Banking and Finance, also at Makerere, serving there from 1987 until 1990.

He then served as Dean Faculty of Commerce, Makerere University from 1991 to 1998. In 1997, he was instrumental in the creation of Makerere University Business School (MUBS).

MUBS was created in 1997 by the merger of the former faculty of Commerce at Makerere University and the then National College of Business Studies, Nakawa. Prof. Balunywa headed MUBS at its inception in 1997 as the school’s first Director.

In 1998, the position of Director was changed to Principal. In June 2018, Waswa Balunywa began another three-year term as the Principal of MUBS.

He also served on the Board of Directors of the Bank of Uganda and national banking regulator, from 2001 until 2012.

Reasons why the President is delaying the renewal of Kasekende’s contract

The reasons for the delaying tactics are not yet known but fact is that President Museveni is a strategic planner.

But it should be noted that Finance Minister Matia Kasaija has been quoted saying that he has severally written to President Museveni informing him of the near expiry of the term of the deputy governor but he is yet to receive a response from State House.

The finance minister says it is not up to him to renew Dr Kasekende’s tenure as it is the president’s mandate to do so.

Dr Kasekende, 61, who has served at BoU since 1986, according to close associates, is still very much interested in getting another term (Kisanja) at BoU. But the appointing authority is painfully taking his time, as if he is not interested in matters concerning BoU. That means that Kasekende’s days at BoU are now numbered, unless President Museveni does a ‘miracle’.

But it should be noted that Kasekende has been running BoU for years under the veil of his frail boss Governor Emmanuel Tumusiime Mutebile.

Due to Mutebile’s deteriorating health condition, the responsibility of the efficient running of the central bank rested on Dr Kasekende’s shoulders for the last 10 years and firing him now would create a deep void in BOoU management, according to business analysts.

Dr Kasekende was appointed deputy governor in January 2010 as Mutebile started showing signs of tiring and old age was catching up with him.

The term of governor and deputy is for five years, which means Kasekende has already served two terms and has vast experience in the management and operations of the Central Bank.

He should have used this to drive BoU into the right direction. In fact, the opportunity came around 2015/16 when Prof Mutebile was bedridden, and Kasekende was fully in charge of the Bank of Uganda.

Unfortunately, Kasekende’s name has in the past showed in various scandals that BoU ha been cited in. Chief among those is the dubious winding up and sell of Crane Bank, which was announced by Bank of Uganda as a regulatory control move.

However, its effect on the economy was mammoth with many business people hitting a dead end as Crane Bank was their last resort in running their day to day finance operations.

Then, Crane bank was sold to DFCU bank by BoU, a move which turned out catastrophic and has haunted the managers of the central bank to this day.

Even the managers of Dfcu bank managers are cursing why they ever bought Crane Bank and inherited its assets and liabilities.Currently, Dfcu Bank has since closed all its branches which they had opened up in buildings previously leased by Crane Bank from Meera Investment LTD.

Both the Auditor General and Parliament have pointed out several regulatory and management errors in the procedures taken in closing not only Crane Bank, but also the other defunct commercial banks, which were closed under Kasekende’s eye.Lesgilators who were. It was hard to believe that directors admitted to selling banks, for example, on telephone or Whatsapp messages.

Kasekende’s Profile

Kasekende joined Bank of Uganda in 1986, serving in different roles until he reached deputy governor position. He in between also worked for the international monetary fund (IMF), World Bank and African Development Bank. He has his first degree in Economics from Makerere University, a diploma in Econometrics, Masters in Econometrics and PhD in the same discipline.