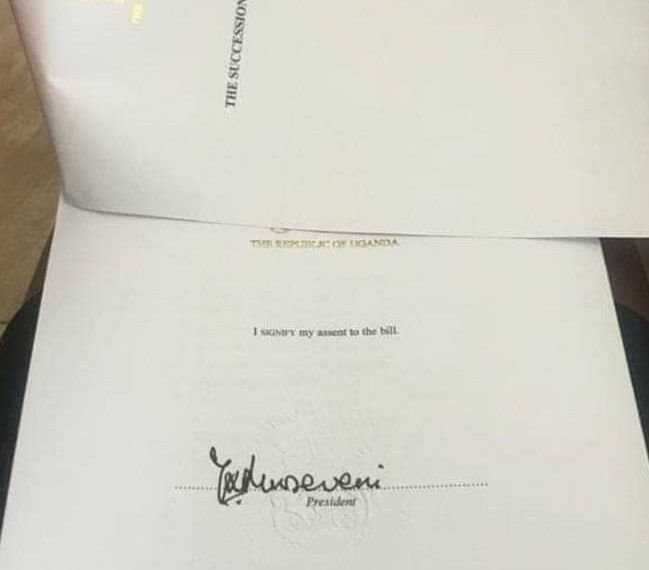

President Yoweri Kaguta Museveni on 10th April, 2022 assented to the Succession Amendment bill 2022 into law.

The bill was first passed by Parliament in March 2021 seeking to ensure equality and equity in the distribution of the deceased estates.

The new amendment was repealing the old succession law which was made way back in 1906.

According to the new law, a customary heir or heiress is defined as a person recognized under the rites and customs of a particular tribe or community of a deceased person as being the customary successor of that person.

While a spouse is a husband or wife married in accordance with the laws of Uganda or in accordance with the laws of another country and recognized in Uganda as a valid marriage.

Highlights

The amendment of section 26 of the principal (2a) states that upon the death of a surviving spouse, the residential holding or any other residential holding shall devolve to the lineal descendants equally, who shall occupy it subject to terms and conditions set out in the Second Schedule to this Act.

A person who evicts or attempts to evict a surviving spouse, lineal descendant or dependent relative who is entitled to occupy the residential holding or any other residential holding commits an offence and is liable, on conviction, to a fine not exceeding one hundred and sixty-eight currency points or imprisonment not exceeding seven years or both.

Sections 29 and 30 are about distribution on the death of the intestate; Which state that the estate of an intestate, except for his or her residential holding or other residential holdings, shall be divided among classes in the following manner; where the intestate is survived by a spouse, a lineal descendant, a dependent relative and a customary heir.

The spouse shall receive 20 per cent, the dependent relatives shall receive 4 per cent, the lineal descendants shall receive 75 per cent, and the customary heir shall receive 1 per cent; of the whole of the property of the intestate.

Where the intestate (deceased) leaves no surviving spouse or dependent relative, the lineal descendants shall receive 99 per cent; and the customary heir shall receive 1 per cent. And where the intestate is survived by a spouse, a dependent relative and a customary heir but no lineal descendant the spouse shall receive 50 per cent, the dependent relative shall receive 49 per cent; and the customary heir shall receive I per cent; of the whole of the property of the intestate;

Where the intestate is survived by a customary heir, a spouse or a dependent relative but no lineal descendant, the customary heir shall receive I per cent and the surviving spouse or the dependent relative, as the case may be, shall receive 99 per cent, of the whole of the property of the intestate.

Where the intestate leaves no person surviving him or her other than a customary heir capable of taking a proportion of his or her property, the estate shall be divided equally between the relatives nearest in kinship to the intestate.

A spouse who remarries before the estate of the deceased is distributed shall be entitled to the share he or she would be entitled to under subsection (1).

Where the customary heir is at the same time a lineal descendant of the intestate, the customary heir shall in addition to his or her share as a customary heir, be entitled to share as a lineal descendant.

A spouse or lineal descendant of an intestate occupying a principal residential property or any other residential property under section 26 shall not be required to bring that occupation into account in assessing any share in the property of an intestate to which the spouse, lineal descendant or child may be entitled under section27.”

A surviving spouse of an intestate shall not take any interest in the estate of the intestate if, at the death of the intestate the surviving spouse was separated from the intestate as a member of the same household.

Also, Section 1 which talks of sharing of the deceased’s property shall not apply if; the surviving spouse has been absent at the time of his or her death, or the deceased had separated from the surviving spouse as a member of the same household, or the intestate is the one who caused the separation.

However, notwithstanding subsection (1), the court may for good cause, on the application made within six months after the death of the intestate, by or on behalf of a surviving spouse, declare that subsection (1) shall not apply to the surviving spouse.

However, for the avoidance of doubt, a child or lineal descendant sired by the surviving spouse and the intestate shall be entitled to benefit from the estate of the intestate, notwithstanding the separation of the surviving spouse from the intestate as a member of the same household.

On who may manage the estate of the deceased, the surviving spouse shall have preference over any other person in the administration of the estate however her preferences may be disregarded in the case may be disregarded by the Administrator-General find is that the surviving spouse is not a fit and proper person to administer the estate or finds it necessary, in the circumstances of the estate, to grant the administration of the estate to another person.

A person to whom letters of administration are granted under subsection (1) shall administer the estate for a period not exceeding two years. However, the court may extend the time if it is in the best interest of the beneficiaries to extend the period.