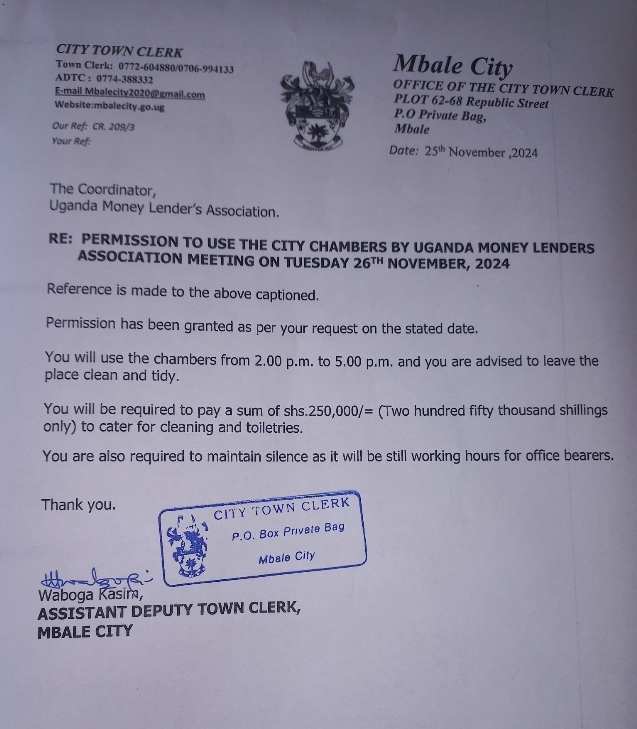

On November 26, 2024, a meeting chaired by Ijjo Emma, the chairman of the Elgon Money Lenders Association, was held at the Mbale City Chambers to discuss strategies for approaching President Yoweri Museveni regarding what they described as abnormally low interest rates imposed on money lending.

Through their chairperson, the Mbale money lenders appealed to the President to intervene in the decision by the Minister of Finance to enforce a uniform interest rate of 2.8% per month on money lending. They expressed concern, stating that the new rate has left them feeling neglected as Ugandan citizens and business stakeholders.

The money lenders argued that they contribute significantly to Uganda’s economy through tax payments and other financial activities. They believe the enforced interest rate does not reflect the operational costs they incur.

A few days ago, the Uganda Microfinance Regulatory Authority (UMRA) issued a directive mandating all money lenders to implement the new interest rate with immediate effect. According to the directive, lenders will only be allowed to charge UGX 280,000 on every UGX 10 million borrowed, which the money lenders claim is too low to sustain their businesses.

The association is now seeking the President’s intervention to reconsider the directive and provide a more favorable solution for their industry.

![]()