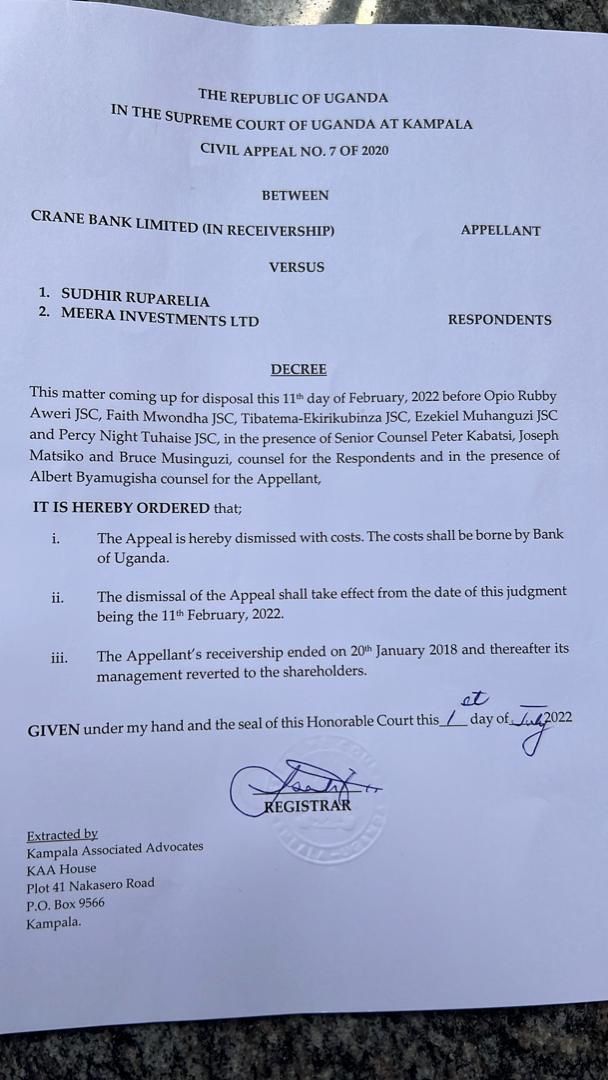

Last Month, the Supreme Court of Uganda issued an official decree directing Bank of Uganda to pay costs to businessman Sudhir Ruparelia and his Meera Investments Ltd following its February 11th 2022 landmark ruling in the Crane Bank case.

In the 1st July, 2022 order, the Supreme Court also told Bank of Uganda to return Crane Bank to its shareholders since the appellant (Crane Bank Limited)’s receivership ended on 20th January, 2018.

In February this year, the Supreme Court dismissed Bank of Uganda’s appeal against Dr Sudhir & his Meera Investments company.

In its ruling, Court ordered BoU to directly pay costs at all court levels as well as return Crane Bank to its original owners.

The ruling was delivered by a panel of five Judges who included; Rubby Opio Aweri, Percy Tuhaise, Ezekiel Muhanguzi,Prof.Tibatemwa Ekirikubinza and Faith Mwondha.

“For avoidance of doubt, the Court of Appeal upheld the finding of the trial court which ordered that the costs of the suit were to be borne by the Bank of Uganda since it was behind the filing of the suit and other subsequent actions. That order shall stand,” the Supreme Court ruled.

“We equally considered this aspect in our ruling and found that indeed, receivership of the appellant (Crane Bank in receivership) had ended on January, 20, 2018. The implication of that finding in our view is that the management of the appellant be reverted to shareholders after the January, 20, 2018.”

Last year in September, Bank of Uganda decided to withdraw a Supreme Court appeal that was contesting the Court of Appeal’s dismissal of the case it filed on behalf of Crane Bank Ltd (in Receivership) vs. Sudhir Ruparelia and Meera Investments Ltd.

In a September 15, 2021 notice of withdrawal, the Supreme Court Registrar indicated that BoU had decided not to prosecute the appeal and would pay costs.

In 2020, Bank of Uganda ran to the Supreme Court to appeal the Court of Appeal ruling, which upheld an earlier High Court decision to dismiss a case that had been filed against businessman Sudhir by Crane Bank in receivership.

Prior, the Court of Appeal in Kampala threw out a case against Dr Sudhir.

The Panel of judges led by acting Chief Justice Alfonse Owiny- Dollo upheld the judgment of Commercial Court judge David K. Wangutusi in application filed by Bank of Uganda seeking a refund of Shs397 billion from Sudhir which he allegedly siphoned from the defunct Crane Bank. Court dismissed case with costs.

Bank of Uganda/Crane Bank in receivership (BoU) had appealed against an August 26, 2019 ruling where the High Court Commercial division dismissed with costs, the multi-billion lawsuit.

In his ruling, Justice Wangutusi stated that BoU/Crane Bank (in receivership) did not have a legal basis to sue Sudhir, the owner of Crane Bank, then the second biggest bank in Uganda.

Court ordered Bank of Uganda to pay Sudhir’s legal costs.

BoU /Crane Bank in Receivership had sued the property mogul and Meera Investments Limited for allegedly fleecing the defunct Crane Bank Limited (CBL) of Shs397 billion that the central bank wanted refunded.

Sudhir denied the allegation and has since counter-sued BoU, seeking compensation of $8m (Shs28 billion) in damages for breach of contract.

He asked the Commercial Court to dismiss the case arguing that the central bank over stepped its mandate in commencing court proceedings against him and his Meera Investments Company.

Presenting an objection against BoU, Sudhir through his lawyers Kampala Associated Advocates told Justice Wangutusi that when dissolving a bank, BoU had three options including putting someone else in its management – what is termed as statutory management, receivership or liquidation.

Counsel Elison Karuhanga argued that however, BoU chose to go for receivership yet under the law, specifically only the manager and the liquidator of the said bank is mandated to file a suit and not a Receiver.

He further explained that, BoU as a Receiver could only dissolve or sell Crane Bank within 12 months but not sue it’s managers.

However, in response to the submissions of Sudhir’s lawyers, BoU through its lawyer Dr Joseph Byamugisha told court that when a financial institution is placed under receivership the power to commerce or to continue with a civil suit does not stop.

BoU on October 20, 2016 placed Crane Bank under statutory management for being under-capitalised.

The central bank attributed the under-capitalisation to mismanagement and insider lending, resulting in Crane Bank’s unsustainable non-performing loan portfolio. The bank was later sold to dfcu Bank in January 2017, although the central bank retained some of its liabilities.

Bank of Uganda closed Sudhir’s bank, then the second biggest bank, and largest indigenous financial institution

Meanwhile, separate investigations by the Auditor General and Parliament recently found contrary information regarding the takeover and sale of Crane Bank. It was also discovered that BoU managers fell short of professionalism, having closed six more banks in the same shabby and illegal manner.