MTN Uganda’s stock on the Uganda Securities Exchange (USE) has risen sharply from Ush270 to Ush312 per share as of Tuesday, November 25, 2025, an impressive 15.6% increase recorded over just four months.

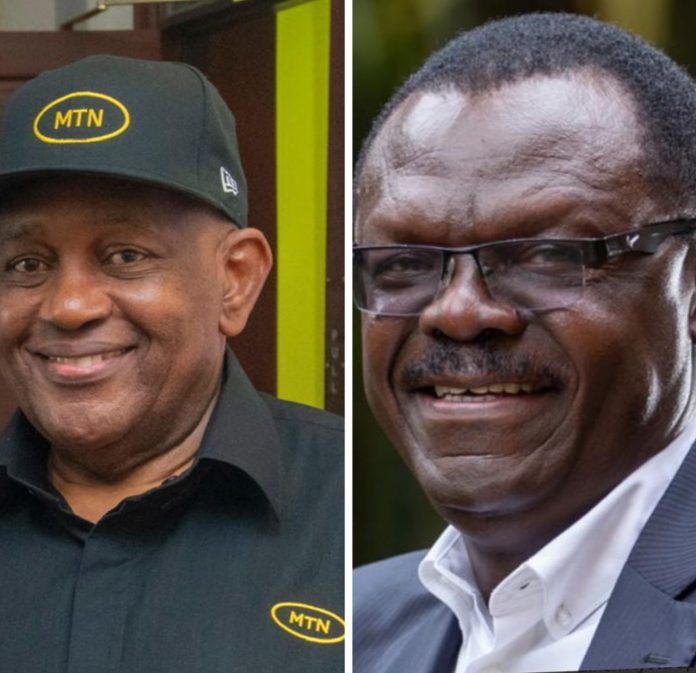

This surge has delivered significant gains to the company’s major local shareholders, particularly the National Social Security Fund (NSSF) and MTN Uganda Board Chairman Charles Mbire.

NSSF, which holds a 10.7% stake in MTN Uganda, initially had investments of shs 2,629,607,910. Over the last four months, each NSSF-held share gained shs 42 in value. When multiplied by the initial investment, this results in shs 110,443,532,220.

Using the current exchange rate of $1 = 3609 shs, the fund’s value addition stands at USD 30,610,480 in the last four months.

With the new share price at shs 312, the current value of NSSF’s holding in MTN has increased to 820,437,667,920, equivalent to USD 227,392,141. This figure is calculated by multiplying the initial investment by the new MTN share price of shs 312.

Similarly, MTN Uganda Chairman Charles Mbire, who holds a 4% stake initially valued at shs 895,561,810, has seen a value addition of shs 37,613,596,020. Based on the prevailing dollar rate, this represents $10,424,968 in added value in the last three months.

Mbire’s new total share value now stands at shs 279,415,284,720, derived from multiplying MTN Uganda’s new share price of shs 312 by his initial investment. In dollar terms, his holding is valued at USD 77,422,616, according to the latest exchange rate.

The surge in MTN Uganda’s stock price reflects the company’s continued dominance on the USE, propelled by strong financial performance, an expanding subscriber base, and consistent dividend payouts.

Over recent years, MTN has reinforced its status as a leading player in East Africa’s telecom sector, drawing sustained interest from both institutional and retail investors.

For NSSF and Mbire, the recent stock performance highlights the substantial wealth gains that can be derived from strategic shareholding in a high-performing company.

As MTN Uganda continues to grow and consolidate its market position, its major local shareholders are poised to benefit even further solidifying the telecom giant’s reputation as one of Uganda’s most reliable long-term investment options.