The journey to cleaning Uganda’s Banking Industry is one that can only be undertaken by courageous Ugandans as there are some individuals using their institutions/associations to oppose the Banking Reforms being suggested by one of Diamond Trust Bank Uganda’s top client and renowned businessman, the C.E.O of Ham Enterprises (U) Ltd Mr. Hamis Kiggundu. After a very horrible experience of irregular and fraudulent transactions carried out on Ham Enterprises’ Accounts, the client dragged DTB Uganda to the Commercial Division of the High Court.

The 120Bn fraud case filed by Ham Enterprises against Diamond Trust Bank Uganda and Diamond Trust Bank Kenya, continues at the Commercial Division of the High Court. On August 28,2020 Ham Enterprises through lawyer Fred Muwema filed a preliminary Objection asking the court to dismiss the defendants defense on basis of its illegality background.

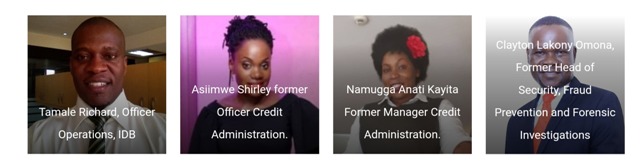

As earlier reported, the details about who is going to testify against Diamond Trust Bank Uganda, that equally stands accused by Ham Enterprises of aiding and abetting the fraud and illegalities jointly committed with Diamond Trust Bank Kenya emerged. The current and former Officers for Diamond Trust who directly worked on accounts listed in the Fraud Case, expressed their patriotism by volunteering to testify against the Bank in this Fraud case at Court which is also referred to as a national case by many concerned parties in the business community.

These witnesses assured us that they will be mentioning names of Specific Bosses who instructed them to unlawfully debit huge sums of money from Ham Enterprises’ Accounts. We further revealed how Diamond Trust Bank started making threats to witnesses that they would testify and give pinning evidence against it in court.

Meanwhile, this website has learnt that Diamond Trust Bank has now continued to intimidate these witnesses to the extent of reporting falsehoods against the witnesses in the case as witnessed in several online tabloids.

Some of these witnesses left the bank due to the fraudulent and illegality activities in the bank, the witnesses went through a question session in an exit interview talking about their experience as the bank’s HR policy states.

Based on the false media reports in different tabloids incriminating these witnesses. They have continued to live in total fear for their lives simply as a result of the bank’s unlawful periodical debiting of huge sums of money from the client’s accounts on “instruction from above” and they have stood up for Uganda as their and patriotically come out to testify. Should any thing bad happen to any of these witnesses, the public should know that it is DTBs panic out of fear for their testimony set to pin the bank in the 120Bn fraud case henceforth, Diamond Trust Bank is held liable and fully answerable.

These witnesses who were working in the bank are very key to redeeming the banking industry of this nation. This is the reason the bank is very scared of their testimony in court hence getting people and tabloids to start alleging falsehoods against the witnesses in the case and as a result; massively endangering their lives.

There is an element of people that want to insinuate these witnesses who have patriotically offered themselves to redeem the banking industry in the interest of their motherland Uganda and hence they are being attacked by those who are very comfortable with the status quo is questionable to majority of Ugandans and many are calling for banking reforms in the industry of current affairs in Uganda’s banking industry which status quo has been questioned by a prominent client in Diamond Trust Bank Uganda who has gone ahead to recommend some banking reforms in the industry such as:

- Revising the structures of foreign banks in the Ugandan economy by employing Ugandans to take some key positions in these banks than having all key positions filled with foreign directors who do not have a clear picture of the needs of budding entrepreneurs in Uganda. We all need to recall that close to 95% of Banks in Uganda are foreign banks.

- Put in place systems that protect Ugandan business men and women from being segregated, discriminated and given unfair interest rates on top of delayed loan processing time compared to foreigners doing business in Uganda.

- Banks operating in Uganda should have partly local Ugandan ownership in their shareholding with a reasonable number of Ugandan directors that seat at their board of directors with direct involvement in decision making from the top to cater for Ugandan interests as a country.

- Calling for banks to have sufficient operating capital to necessitate huge borrowing for developmental projects that facilitates national growth other than merely operating in our deposits and savings as Ugandans.

- Control the repatriation of profits by foreign banks to their parent countries which means that Uganda is used as a conduit.

Therefore, it should be noted that the journey to reform Uganda’s baking industry has got some people fighting it, however, with the ongoing 120Bn fraud case in court. It is very likely to change.

It is totally un acceptable for such foreign banks with no national interests to continue threatening Ugandans who are patriotically standing up for their Country Uganda desiring redemption of the banking industry. It is really unfair and unjust of these elements of people and banks to take Ugandans and Uganda at large for granted. This has become a case for all Ugandans if we are to realize economic independence as a nation at large.

No Ugandan deserves to be intimidated simply for standing up for their mortherland Uganda.

The trial judge, Henry Peter Adonyo is set to give his ruling on the Dismissal of DTB’s defense on Monday 5th October 2020, we shall keep you updated. Watch this Space!

![]()