Michael Maranga Mawanda the Igara East legislator has presented Constitutional Amendments Bill 2020 on the leadership composition at the Bank of Uganda (BoU).

Mawanda’s bill comes after reports from the Public Accounts Committee (PAC) and Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) and the special audit report of the Auditor General on the closure of commercial banks. Parliament resolved that the amendment of Article 161 of the Constitution be introduced in the house within 90 days after the adoption of the committee report.

Mawanda’s impending bill is in line with recommendations made in February 2019 by the parliament’s committee on Commissions, Statutory Authorities and State Enterprises [COSASE] after probing BoU on the controversial closure of seven commercial banks, including Crane Bank Limited in 2016 and Global Trust Bank Uganda in 2014.

According to Mawanda, the “Bank of Uganda Amendment Bill 2019” is aimed at addressing the current scandals at the central bank, adding that it would further protect the falling economy.

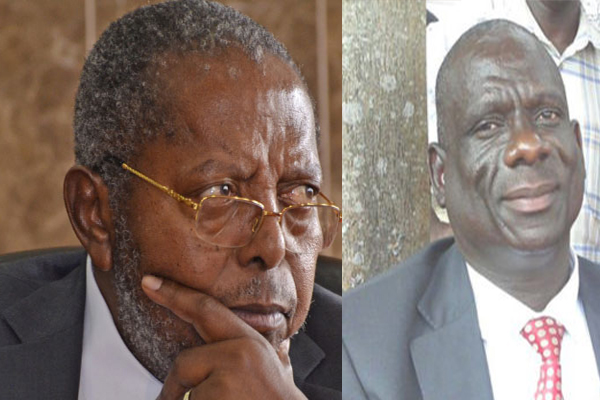

During the COSASE probe, led by MP Abdu Katuntu as Chairperson, it was established that Emmanuel Tumusiime-Mutebile the BoU Governor reports to himself since he chairs the BoU Board and this is worsened by the fact that his deputy Dr. Michael Atingi-Ego is the Vice Chairman of the board.

Mawanda believes his bill will restore order, credibility and public trust that has since been lost thanks to Governor Mutebile and his deputy Atingi-Ego-led administration. It was made worse when a confidential Presidential Tripartite Committee report revealed that Tumusiime-Mutebile in March 2018 hired top officials in disregard of the BoU Act.

While appearing before the Legal and Parliamentary Affairs Committee which is currently debating constitutional amendments and chaired by Jacob Oboth Oboth, Mawanda proposes the governor and all other members of the board shall be appointed by the president with approval of parliament and shall hold office for a period of five years and shall be eligible for renewal.

“The clause in Article 161 proposes that the Governor will be the Chief Executive of the central bank and my thinking is that this will promote good governance principles. The board shall be responsible for the formulation of the policy and the Governor who shall be Chief Executive shall be responsible for the implementation of the policy”Mawanda said.

Mawanda bill if adopted by the House will reduce the powers of the governor Bank of Uganda by separating his roles as a governor from that of chairperson board of the bank like is the current situation.

The bill also wants parliament to be the responsible body in appropriating resources or approving BoU financial year budget.

The bill will also outline procedures for closing insolvent banks and ensure people like Mutebile do not practice nepotism at the institution as was the case reported in the Presidential Tripartite Committee report.

…

Credit Eagle online

2 total views , 1 views today