The Bank of Uganda (BoU) has decided to withdraw a Supreme Court appeal that was contesting the Court of Appeal’s dismissal of the case it filed on behalf of Crane Bank Ltd (in Receivership) vs. Sudhir Ruparelia and Meera Investments Ltd.

In a September 15 notice of withdrawal, the Supreme Court Registrar indicates that BoU has decided not to prosecute the appeal and will pay costs.

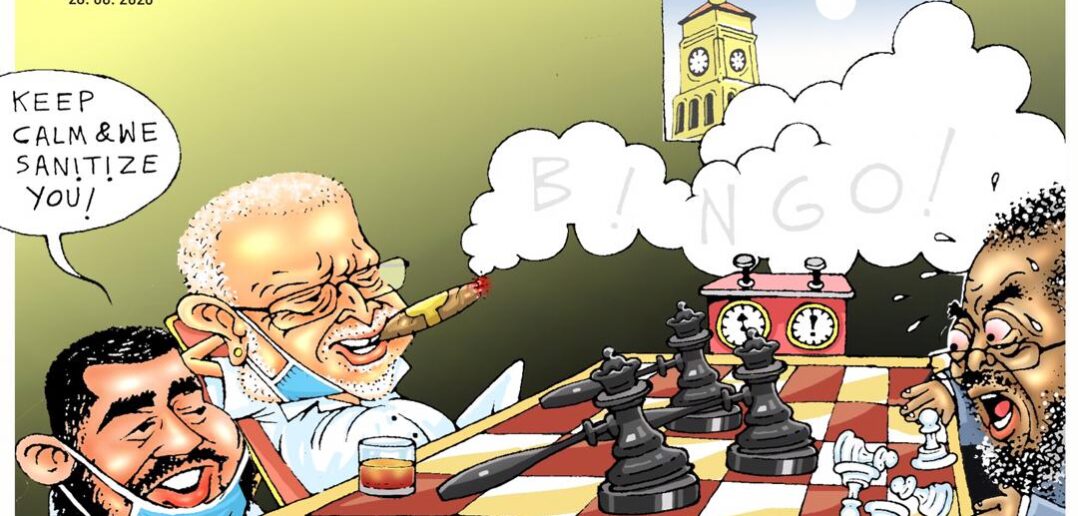

The notice is signed by the central bank lawyers Messers Byamugisha & Co Advocates, confirming the latest victory for Mr Ruparelia who has given the BOU a run of their money in the court, ever since they closed his bank.

On June 23, 2020, the Court of Appeal upheld the judgment of the Commercial Court in an application filed by BoU seeking a refund of UGX 397 billion from city tycoon Sudhir Ruparelia which he allegedly pulled out from Crane Bank, before it was closed by the central bank in January 2016.

Justice David Wangutusi of Commercial Court in August 2019 dismissed the first case in which BoU claimed that Ruparelia and his Meera Investments Ltd fleeced his own Crane Bank Ltd (now in receivership) of UGX397 billion.

On Tuesday, June 30, the BoU had insisted that receivership does not take away the corporate personality of a company which includes the right to trace and recover assets and the right to sue for those assets.

In the preliminary stages of the appeal, the Supreme Court in August this year, dismissed with costs, an application by lawyers representing the Bank of Uganda (BoU) in which they sought to substitute the court record from Crane Bank Ltd (in receivership) to Crane Bank Ltd (in Liquidation), with the court rejecting the move, as in bad faith and intended to circumvent facts.

A panel of the Supreme Court Justices including Ruby Opio-Aweri, Faith Mwondha, Lillian Tibatemwa, Ezekiel Muhanguzi and Night Tuhaise, in a ruling issued on August 12 rejected arguments by BoU lawyers led by veteran attorney Dr. Joseph Byamugisha, reasoning that Crane Bank Ltd (in Receivership), Crane Bank Ltd (in Liquidation), and Crane Bank Ltd are three distinct entities with different rights, powers and obligations.

Earlier in the High Court, Justice Wangutusi noted in his ruling that at the time BoU and Crane Bank (in receivership) filed the suit against Mr Ruparelia and his Meera Investments in January 2017, Crane Bank was a non-existing entity, having been terminated when the Central Bank sold its assets to DFCU Bank in October 2016.

The judge ruled that this rendered Crane Bank in receivership incapable of suing or being sued since there would be no assets to be claimed for.

Court noted that the public notice made it clear that BoU as the receiver had done an evaluation of the respondent (Crane Bank in receivership) and arranged for the purchase of its assets and assumption of its liabilities by another financial institution.“

In his [BoU] notice, he specifically stated that the liabilities of the respondent had been transferred to DFCU Bank Ltd and that because DFCU Bank had taken over the liabilities, it would, by way of consideration, be paid by conveying to it the respondent’s assets,” the judge ruled.Bank of Uganda, through their new attorney Dr. Joseph Byamugisha of Byamugisha & Co Ltd the chose to file an appeal.

12 total views , 1 views today