The Supreme Court has on Monday October 4, 2021 ruled that liquidation of defunct Crane Bank Limited which was taken over by Bank of Uganda is illegal.

According to Supreme Court, Crane bank was closed as a financial institution and placed under receivership and hence after closure, it ceased being a financial institution.

The Court first overruled the objection by Bank of Uganda that it is immune from being sued under the law governing Banks in Uganda. Court found that Bank of Uganda can be sued for anything done in bad faith. Court found that in the instant case Bank of Uganda was rightly sued as it had acted in bad faith by placing Crane Bank into Liquidation which was after losing the appeal in the Court of Appeal that upheld the high court ruling that Crane Bank under Receivership could not sue and that receivership had ended.

The Court further found that changing the status of Crane Bank (in Receivership) to Crane Bank (in liquidation) would render the appeal before it moot and nugatory (unnecessary). Therefore this was a proper case of granting an injunction restraining bank of Uganda from continuing with the liquidation of Crane Bank.

Court further issued a mandatory injunction against Bank of Uganda restoring the status of Crane Bank to what it was at the time of filing an appeal in the Supreme Court. The Court reasoned that changing the status of Crane Bank to liquidation would defeat the suit.

Court found that placing Crane Bank into liquidation was illegal. Court reasoned that under the law governing banks in Uganda only a licensed Bank can be liquidated. However, Crane Bank had been closed and put under receivership which meant that it ceased being a bank and could not this be put under liquidation.

Court further found that in placing Crane Bank into liquidation, Bank of Uganda was in contempt of court orders. The move was intended to circumvent the decision of Court of Appeal hence aimed at preventing the course of justice before.

The Court thus allowed the Application and issued orders to the effect that Bank of Uganda should not place Crane Bank into liquidation, an order restraining Bank of Uganda from continuing with the liquidation process, an order restoring the status of Crane Bank to what it was at the time of filing a suit and declared that Bank of Uganda was in contempt of Court Orders.

“The 1st respondent was closed as a financial institution and placed under receivership. Upon closer, it ceased being a financial institution under the Act and it could therefore, not be progressed to liquidation. The 2nd respondent’s act therefore of moving the 1st respondent to liquidation are contrary to the above clear provisions of the law and the same cannot be sanctioned by this court” reads the ruling.

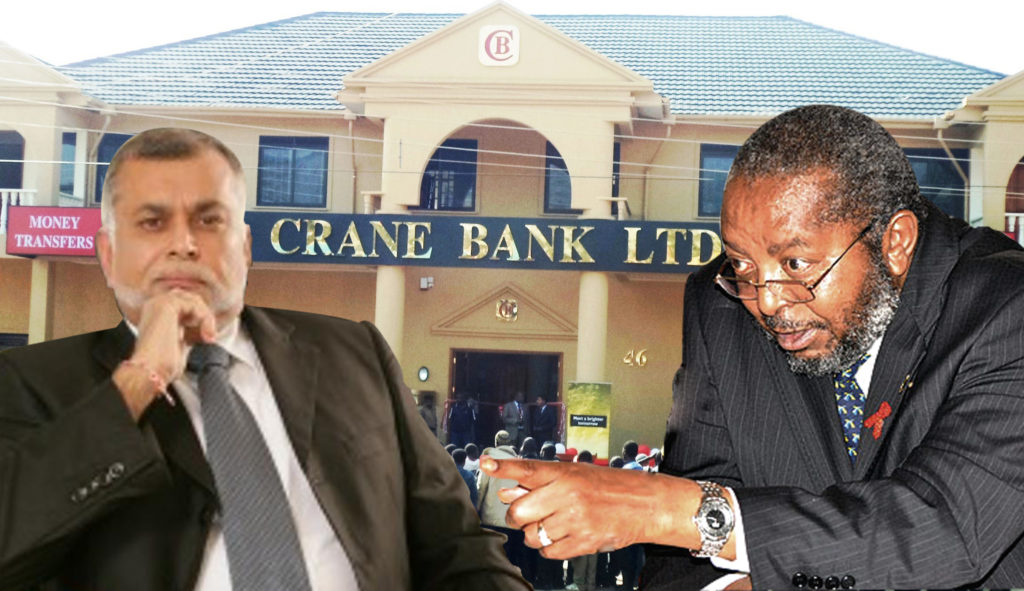

The ruling comes at a time when BoU has just withdrawn a Supreme Court appeal that was contesting the Court of Appeal’s dismissal of the case it filed on behalf of Crane Bank Ltd (in Receivership) versus Sudhir Ruparelia and Meera Investments Limited.

In a September 15 notice of withdrawal, the Supreme Court Registrar indicated that BoU has decided not to prosecute the appeal and will pay costs.

The notice was signed by the central bank lawyers Messers Byamugisha & Co Advocates, confirming the latest victory for Mr Ruparelia who has given the BoU a run of their money in the court, ever since they closed his bank. On June 23, 2020, the Court of Appeal upheld the judgment of the Commercial Court in an application filed by BoU seeking a refund of Shs397 billion from city tycoon

Justice David Wangutusi of Commercial Court in August 2019 dismissed the first case in which BoU claimed that Sudhir and his Meera Investments fleeced his own Crane Bank (now in receivership) of Shs397 billion.

In June 30, the BoU insisted that receivership does not take away the corporate personality of a company which includes the right to trace and recover assets and the right to sue for those assets

In the preliminary stages of the appeal, the Supreme Court in August this year, dismissed with costs, an application by lawyers representing BoU in which they sought to substitute the court record from Crane Bank Limited (in receivership) to Crane Bank Limited (in Liquidation), with the court rejecting the move, as in bad faith and intended to circumvent facts.

A panel of the Supreme Court Justices, Ruby Opio-Aweri, Faith Mwondha, Lillian Tibatemwa, Ezekiel Muhanguzi and Night Tuhaise, in a ruling issued on August 12 rejected arguments by BoU lawyers led by veteran attorney stating that Crane Bank Limited (in Receivership), Crane Bank Ltd (in Liquidation), and Crane Bank Limited are three distinct entities with different rights, powers and obligations.

Earlier in the High Court, Justice Wangutusi noted in his ruling that at the time BoU and Crane Bank (in receivership) filed the suit against Mr Ruparelia and his Meera Investments in January 2017, Crane Bank was a non-existing entity, having been terminated when the Central Bank sold its assets to DFCU Bank in October 2016.

The judge ruled that this rendered Crane Bank in receivership incapable of suing or being sued since there would be no assets to be claimed for.

Meanwhile, separate investigations by the Auditor General and Parliament recently found contrary information regarding the takeover and sale of Crane Bank. It was also discovered that BoU managers fell short of professionalism, having closed six more banks in the same shabby and illegal manner.

17 total views , 2 views today