The Bank of Uganda (BoU) has granted an operating licence to I&M Bank (U) Ltd to begin operating in Uganda after changing its name from Orient Bank.

The Nairobi-based financial Group announced that the rebrand comes after the I&M Group’s successful acquisition of a 90 per cent shareholding in Uganda’s Orient Bank Ltd on April, 30, 2021. This received regulatory approval from the Central Bank of Kenya, Bank of Uganda, Capital Markets Authority of Kenya as well as the Common Market for Eastern and Southern Africa (COMESA), and is part of the Group’s broader strategy to grow its business by increasing its geographical footprint across the Eastern African region.

“The rebrand will not only unlock the bank’s potential, but also will enable it to reach out to more customers within Uganda, and in Eastern Africa as a whole. Further, the move will enable the bank to roll out a more diversified product and service offering to its target market,” said Mr Suleiman Kiggundu, the bank’s chairman.

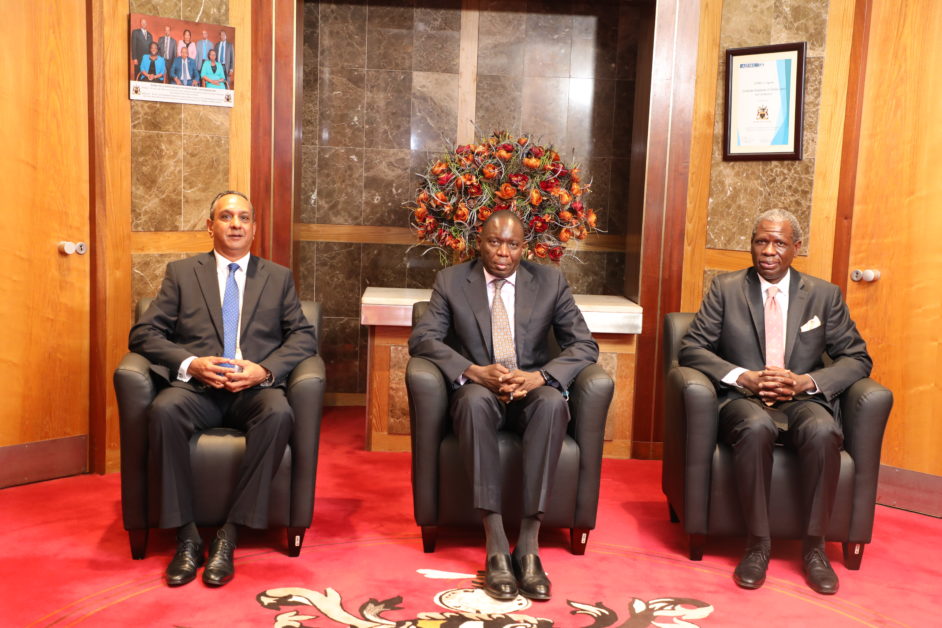

Speaking at the handover of the operating licence on Monday, 08 November 2021, the Deputy Governor, Dr Michael Atingi-Ego, said the innovative championing of digitalization made Orient Bank outstanding and remains one of the most attractive aspects in a world of technology-driven banking.

“The innovative championing of digitalization made Orient Bank outstanding and remains one of the most attractive aspects in a world of technology-driven banking. We anticipate that the enhanced financial muscle and cross-border banking pedigree brought on by the I&M Group that has subsidiaries across east Africa will substantially power the bank to its next evolution,” said Dr Atingi-Ego.

He said that he anticipates that the enhanced financial muscle and cross-border banking pedigree brought on by the I&M Group that has subsidiaries across east Africa will substantially power the bank to its next evolution.

Dr Ego also said I&M Group was attracted to Uganda because of a well supervised banking system.

“It has done well because the regulator, the banking sector, and the economy have also done well, for the majority of the last 28 years. Credible macroeconomic management, sound legal and regulatory policies, political stability, and an improving business environment have been key enablers along the way,” he said.

“We believe that the strong partnership between the Bank of Uganda and the banking sector has been constructive and will remain conducive for I&M Bank (U) Ltd going forward,” he added.

Also speaking during the rebrand press conference, Mr Kumaran Pather, the bank’s CEO said that I&M Uganda will focus on supporting critical sectors that impact growth across the region, including agriculture, transport, technology and manufacturing through offering attractive, digital-focused solutions.

“I&M Group Plc and its subsidiaries have made significant investments in key sectors across Eastern Africa’s regional economy, including banking and finance, SMEs, real estate, financial technology, trade, agriculture, and infrastructure,” said Pather

“The rebranding is the latest step in an operations overhaul which has been ongoing for the last one year and has included retraining of staff, enhancing customer relations and upgrading its core banking system.” Mr. Pather added that “I&M Group has made significant investments in its technology infrastructure as part of its digital transformation journey in the region. Reflecting its commitment to its clients and the markets it serves, the bank and its staff have invested significant time and resources to refine the new I&M Bank brand and to seamlessly integrate new platforms and offerings.”

“We are extremely excited to announce today’s launch and rebrand, aligning our digital capabilities as well as our brand elements to keep pace with our industry-leading achievements and our unique products and services within the East African region,” said Mr Pather.

Having started in 1993, Orient Bank (U) Ltd, had 14 branches and 14 ATMs across the country, serving corporate, SME, and retail clients.

![]()