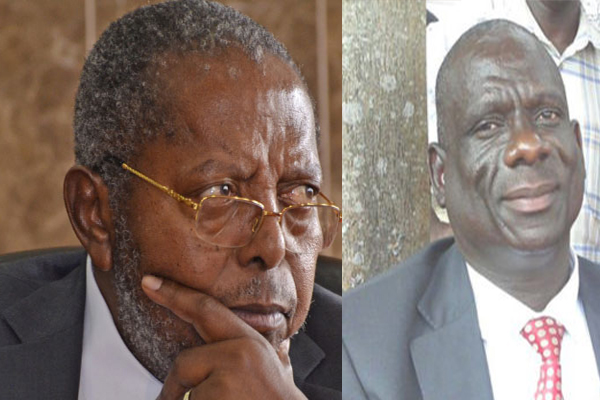

The Parliament of Uganda through Igara East Member of Parliament, Hon Michael Mawanda is working on a, ‘Constitution (Amendment) Bill, that seeks to, among others, remove the Governor and Deputy Governor of Bank of Uganda from being Chairperson and Vice Chairperson respectively of the Central Bank.

According to Hon. Mawanda, the decision making authority is bestowed unto the board which is headed by the Governor who also serves as the administrative head of the Institution adding that, ‘this creates conflict of interest’.

The Capital Times understands that Mr. Mawanda based his bill on the reports of Public Accounts Committee (PAC) and Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) and the special audit report of the Auditor General on the closure of commercial banks including Sudhir Ruparelia’s Crane Bank.

Sale Of Crane Bank

On June 30, 2017, Crane Bank Limited (in Receivership) took Mr. Sudhir Ruparelia and his Meera Investments Ltd. to court for causing financial loss amounting to UGX 397 billion to Crane Bank in fraudulent transactions and land title transfers.

Crane Bank (in receivership) in its Civil Suit No. 493 of 2017 sought High Court to compel Mr. Ruparelia to pay back the US$80,000,000, US$9,270,172.00, US $ 3,560,000.00, US$990,000.00 and UGX 52,083,995.00 as compensation for breach of fiduciary duty.

While Hon. Justice Wangutusi dismissed the UGX397 billion case against Mr. Ruperalia on a technicality, alleging that Crane Bank (in Receivership) lost its powers to “sue” and to “be sued”, thus rendering its suit a nullity, Crane Bank (in Receivership) maintaining that receivership is a management situation, and hence no legal change as to the capacity of a company to sue and be sued.

Later, BoU appealed to Supreme Court arguing that the decision of shutting Crane Bank was necessary upon discovering that it had significant and increasing liquidity problems that could not be resolved without the Central Bank’s intervention, given that Crane Bank had failed to obtain credit from anywhere else.

“An inventory by external auditors found that the assets of Crane Bank were significantly less than its liabilities. In order to protect the financial system and prevent loss to the depositors of Crane Bank, Bank of Uganda had to spend public funds to pay Crane Bank’s depositors,” Mutebile said then.

However, as the Supreme Court was preparing to decide on the appeal, last month the ‘dramatic’ BoU resurfaced with a letter seeking permission to withdraw the appeal which actually left many thinking that BoU had discovered its faults and was ready to pay the workaholic Sudhir only to find out that this was a trick to evade court costs.

Finally, the Supreme court earlier this week we learnt that it is set to deliver its ruling on that application but Sudhir revealed that he objected to the BoU’s ‘deal’ to withdraw the appeal insisting that the case must either continue or Court should compel them to pay costs.

“BoU is saying Crane Bank in receivership should pay costs, but remember Crane Bank ceased to be in receivership on January 20,2018 and went back to its shareholders, so when you say Crane Bank should pay costs, BoU is simply saying that we should pay for our selves, yet it’s them (BoU) who took us to court and lost in all the two lower courts before they ran to Supreme Court. So now they don’t want to pay the costs,” Sudhir told the press earlier this week at Supreme Court Kololo, a leafy Kampala suburb.

![]()