The Supreme Court in Kampala has ordered Bank of Uganda (BoU) to pay dispute costs after losing yet again in the aftermath of the closure and liquidation of Crane Bank Ltd, owned by businessman Sudhir Ruparelia.

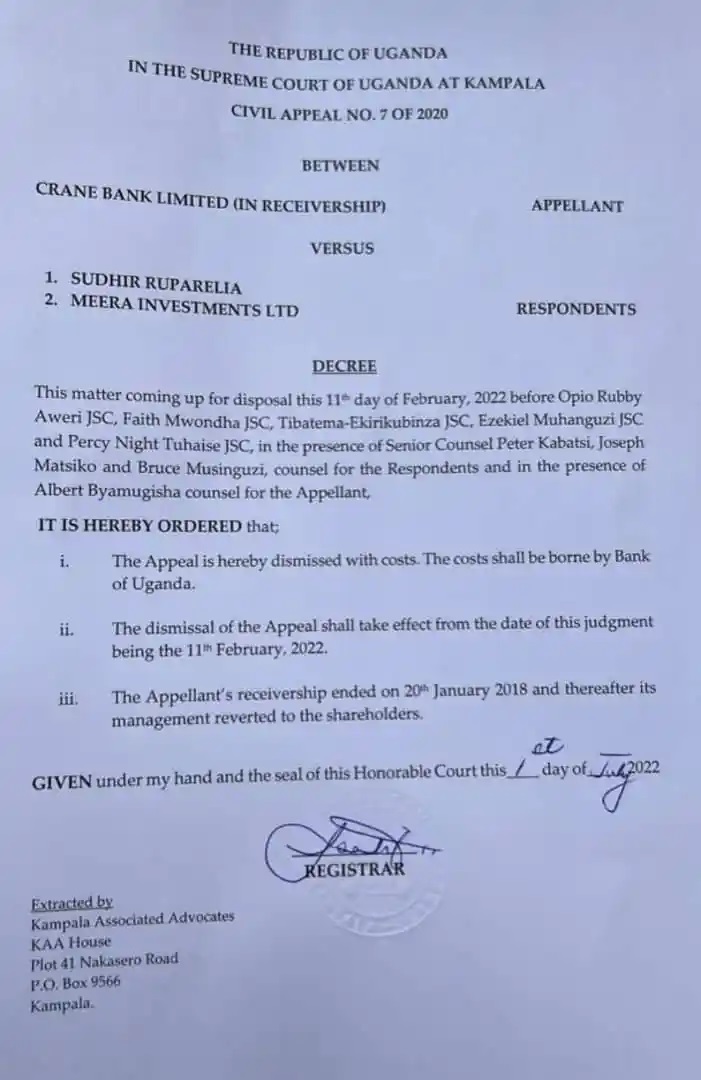

In a ruling delivered on Friday, July 1, a panel of three judges led by Justice Prof. Lillian Tibatemwa-Ekirikubinza unanimously dismissed with costs the latest appeal filed by Bank of Uganda against Dr. Sudhir and his real estate arm Meera Investments in which the bank regulator sought to overturn the decision by Court of Appeal in the February ruling.

“The appeal is hereby dismissed with costs. The costs shall be borne by Bank of Uganda. The dismissal of the Appeal shall take effect from the date of this judgement being the 11th February 2022, ” Justice Tibatemwa stated in a notice read by the court Registrar at the Supreme Court on Friday.

The justices reasoned with the Court of Appeal that management of Crane Bank be returned to the shareholders including Sudhir Ruparelia and Meera Investments Limited since the receivership status had ended in 2018. “The Appellant’s receivership ended on 20th January 2018, and thereafter its management reverted to the shareholders,” the court ruled.

Receivership is the process through which a company’s assets are managed by a neutral party to assist the company to recover funds due to it creditors. The process may also aid the company to return to its profitability.

Speaking to journalists shortly after the ruling, Sudhir said; “Bank of Uganda stole my bank. They have to pay costs of suit right from the Commercial Bank to the Supreme Court.”

What the ruling means

The latest ruling which maintains the earlier decision by the Court of Appeal comes as bad news to DFCU Bank which bought CBL in January 2017 for a paltry Shs200 billion paid in installments and is now struggling to make profits after a terrible performance in the financial year 2020/21.

The ruling also indicates that DFCU will have to revert several assets and liabilities including 48 properties it obtained from CBL (then under BOU receivership) since they were decived by former BoU officials Justine Bagyenda (executive director for supervision and Dr. Louise Kasekende, the former Deputy Governor-BoU.

Remember also that BoU Crane Bank in Receivership tried to get Shs 397 billion from CBL shareholders on allegations of embezzlement of funds of CBL, but the court dismissed the prayer on grounds that Crane Bank in Receivership had no locus Operandi, and therefore it could not sue or be sued.

In the same vein, the Auditor General John Muwanga in his audit report on the sale of commercial banks by BoU established that BoU failed to follow procedures and guidelines and that Shs 478 billion BoU claimed to have sunk in CBL In Receivership could not be explained in entirety as some of it went missing without documentation.

COSASE of the 10th parliament also faulted BoU on close of CBL which only needed about Shs 150bln to stay afloat. MPs on COSASE then said it would be a thing of corruption and unfairness for BoU to demand Shs 397 billion from CBL shareholders when it is BoU that was the Receiver who handled the money.

![]()