Nakku Joweria a resident of Kyebando has sued Stanbic Bank Uganda limited for failing in its duty of protecting her saving account leading to defrauding her or illegal withdrawal of shillings 68 million from her account in a period of 24 hours through Flexi pay an application she had never registered for.

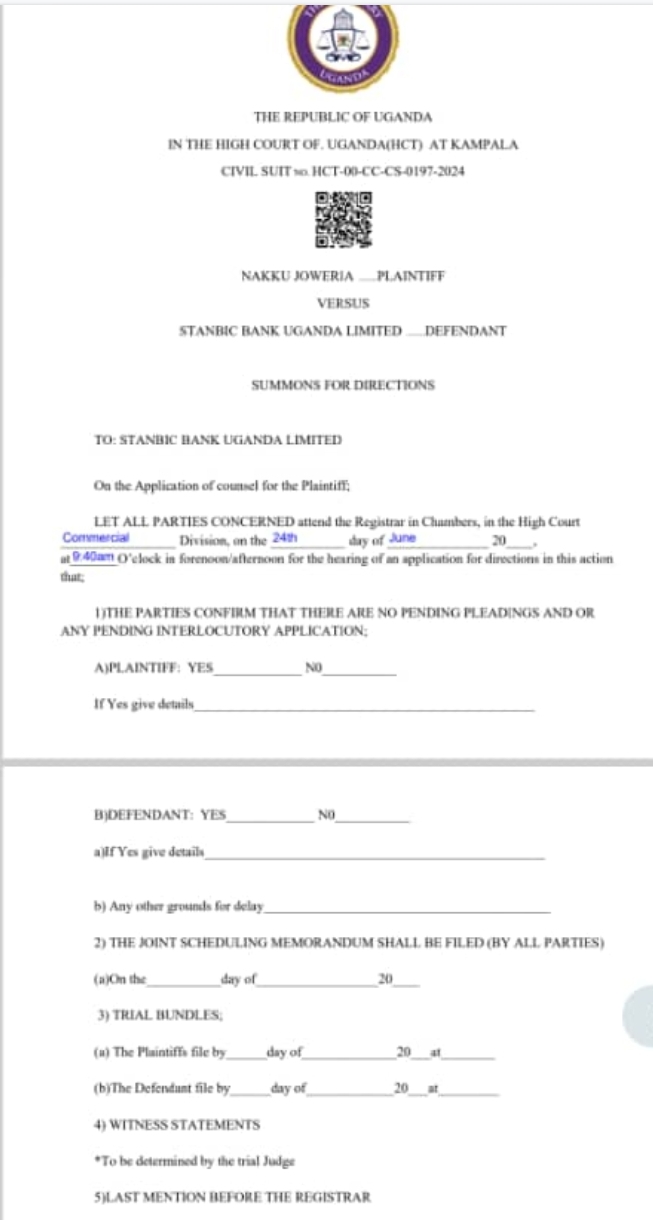

In the court case filed before the Commercial division of the High Court of Uganda and coming up for directions in the registrar Christa Namutebi’ chambers, on the 24th June, 2024 at 9:40am Nakku Joweria through his lawyers of Kimanje Nsibambi Advocates contend that between 7th and 8th of February, 2023, there was unauthorized withdrawal of 68 million shillings from her savings account No. 903000026244 via the Flexi Pay Banking a platform of Stanbic Bank and a total of 28 unauthorized transactions were conducted by fraudsters who fraudulently accessed her account undetected by the bank.

She questions how a savings account which had a transaction limit was significantly exceeded during the unauthorized and undetected fraudulent transactions which led to the loss of her’ money.

“Our client has been a loyal client of Stanbic bank since 2001 way before the implementation of the FlexiPay system and at no point did she sign up for or activate the flexi pay on her savings account.

The 28 unauthorized withdraws on our clients account using four unknown Airtel lines raises serious questions and/ or lapses on the part of the bank for which we hold the bank specifically liable for the loss since it was in a better position to detect and prevent this fraud had it exercised reasonable care to detect these suspicious 28 unauthorized transactions that took place within 24 hours on a savings account that was rarely operated by our client” reads the documents in parts.

She also questions the effectiveness of the bank’s authentication protocols with their flexi pay system, effectiveness of the transaction monitoring to the extent of allowing 28 unauthorized transactions within 24 hours using four unknown Airtel lines and significantly exceeding the account limit.

Nakku wants court to direct Stanbic Bank to reimburse 68 million to her account that was fraudulently withdrawn and pay her the costs and damages.

Background of the case

Nakku Joweria on the 6th of February 2023 lost her phones to the robbers on her way to work at around 9pm which incident was reported to police at 9am and to the telecom companies on the 7th February 2023. However the telecom companies that’s MTN and Airtel couldn’t process the new simcards because she had misplaced her original Nin national Identity card.

The robbers used her MTN number to open up a wallet on the Flexi pay which number had four other Airtel numbers that don’t belong to her which they used to make 28 unauthorized withdraws of 68 million shillings from her Stanbic bank saving account on the 7th and 8th February in a space of only 24 hours.

When she went to withdraw some money from her account on the 6th, March 2023 that’s when she realized that her money was fraudulently withdrawn from her account. She wrote to the bank manager complaining about the matter and the bank promised to do thorough investigations which revealed how the money was withdrawn by the fraudsters.

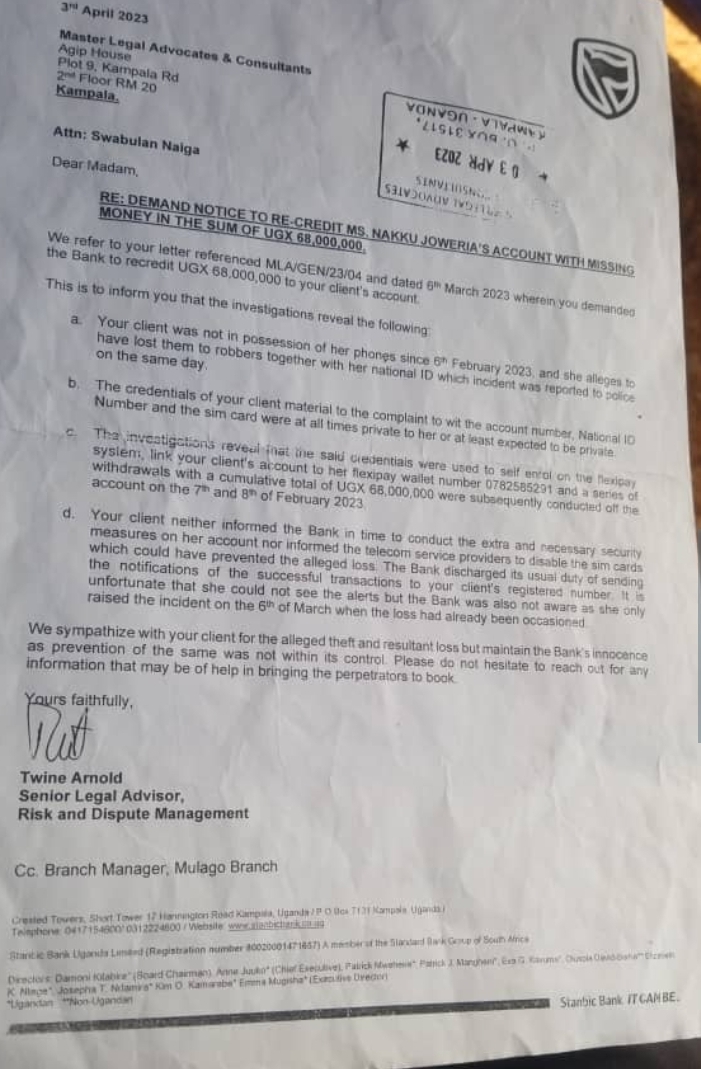

Now through her lawyers of Kimanje Nsibambi Advocates she wrote a demand notice to Stanbic Bank manager to reimburse her money since it was their weakness and fault for failure to efficiently protect her account. The bank through Twine Arnold, the senior legal advisor, Risk and Dispute Management wrote back with an out of court settlement request.

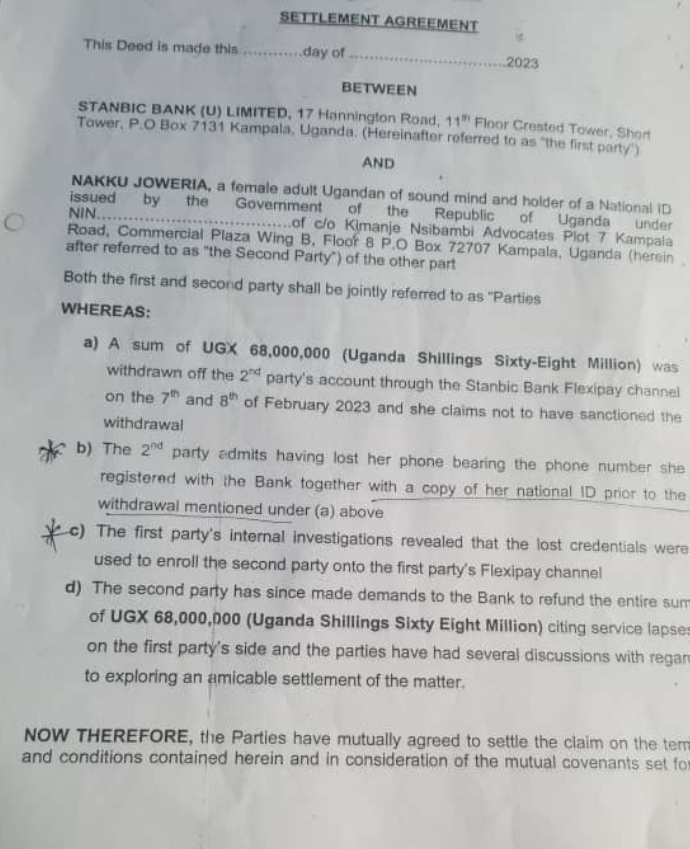

However, the bank had proposed to reimburse only 34 million out of the 68 million fraudulently withdrawn from her account on the basis that the settlement shall not be taken as admission of liability by any of the parties, a proposal she rejected and instead thought for legal redress in the commercial court.

Efforts to talk to Stanbic Bank for a comment by press time were futile as they couldn’t pick our repeated calls.

![]()