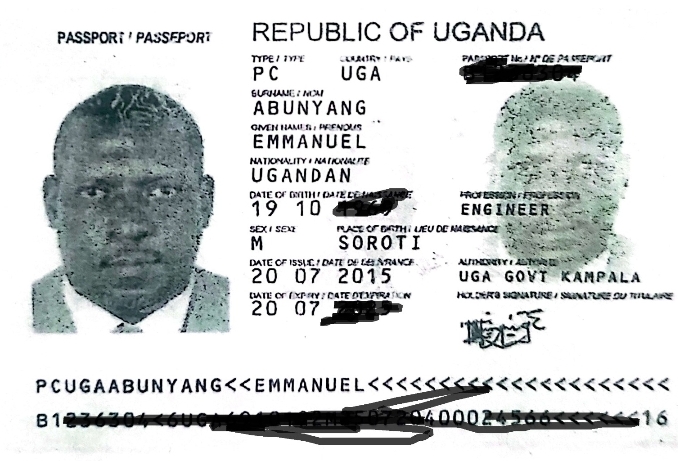

The Ministry of Lands, Housing and Urban Development has cancelled the land title of Emmanuel Abunyang, a Soroti based businessman who owns discothèques in Soroti city over illegalities and fraud.

This follows a Court order dated September 19, 2024 in Civil Suit No.28 of 2021 at Soroti High Court directing the Commissioner Land Registration to cancel the Land Title for property in LRV 3481 folio 9, Plot 14 Akakai Lane in Oderai Ward, Soroti City West Division and reinstate the owner Isaac Eryaku aka Marisa as he is fondly known.

Eryaku was a successful entrepreneur in Soroti City until Uganda Revenue Authority (URA) reportedly unfairly closed his business and auctioned his business equipment which made it difficult to meet loan obligations hence destroying their business empire.

In an order seen by this publication dated October 4, 2024, Court gave Abunyang an ultimatum of 14 days to surrender the duplicate Certificate of title which he acquired through fraudulent means. When we called Abunyang’s known (Tel No.077 2*5 4*22) to verify allegations that he’s in hiding, he neither received nor returned our calls at the time of this publication.

This followed a Court matter filed by Sarah Abuto and Isaac Eryaku as plaintiffs challenging the illegal and fraudulent sale of their property and theft of their Guest house properties and equipment during the illegal eviction of the plaintiffs against Stanbic Bank, Emmanuel Abunyang and Commissioner Land Registration as defendants.

Court documents reveal that Abunyang fraudulently bought the property in question which had a mortgage of sh80mln with Stanbic Bank at the time as security from Stanbic Bank without—proper Notice to the Plaintiffs, consent of the 2nd Plaintiff, an advert, a Public auction and a Valuation Report.

This was contrary to Regulation 11(1) and (2) of the Mortgage Regulations, S.I No.2 of 2021 which is to the effect that before selling any Mortgaged property, the Mortgagee must value the same to ascertain its current market value and forced sale value and shall not be made more than six months before the date of sale.

This, the Judge ruled, made the sale based on no pre-valuation illegal and irregular and that the sale of the impugned property of the plaintiffs by Stanbic Bank and or its agents Sebalu and Lule advocates was neither by public auction nor by private treaty.

According to a sale agreement seen by this publication, the plaintiffs’ property was sold on the March 24, 2016 at sh95mln with the Bank writing to Semaganda Associates in a letter dated 14th April, 2016 to value the plaintiffs’ property and a valuation report was prepared on April 25, 2016 long after the purported sale had taken place.

Evidence on Court record shows that the suit property was valued on November 18, 2015 by CMT Realtors with a value of sh200mln. It’s not clear what motivated Stanbic Bank and their agents to instruct Semaganda and Associates to undervalue the property to accommodate the lower value of sh95mln after the sale to Abunyang.

Stanbic Bank on its part as evidenced in the sale agreement and proceedings on Court record argued that they had conducted a Public Auction but failed to provide evidence to Court.

The Plaintiffs were represented by Richard Omongole of M/S Omongole and Co. advocates and the Bank was represented by Zeere James of S&L Advocates (formerly Sebalu and Lule Advocates) while Abunyang was represented by Okanya Joshua of Alliance Advocates.

To take possession of the property, Court documents reveal that Abunyang broke into the plaintiffs Guest house at night and converted household property and guest house equipment valued at more than sh149mln. The illegal eviction was carried out without notice, Court Order or any lawful authority.

No Court licensed Bailiff handled the process except a group of street goons paid by Abunyang and his lawyer, it was alleged.

Proceedings and evidence in Court further reveal that Emukon Karl Peters who purported to witness the illegal eviction as L.C.1 was denied by the Electoral Commission as an imposter and didn’t testify in Court despite being listed as a witness.

In the judgment, Justice Henry Peter Adonyo found that Abunyang had also under-declared the value of the suit property in order to cheat the Government of Uganda of its revenue.

The Court was shocked that Abunyang had concealed facts by declaring that there were no developments on the impugned suit land yet the property is a fully developed gated complex with a Bungalow with another building next to it, a watchman’s house and a wall fence. The Judge declared that Abunyang’s actions amounted to fraud and illegality which invalidates the whole Registration process.

The Bank was faulted for not issuing all the Notices in their proper sequence as envisaged under the Mortgage law but only tendered a Notice of default and Notice of sale thereby making the whole process of foreclosure for failure to serve each and every mandatory Notice.

Stanbic Bank was also ordered to refund all the illegal interest it deducted from the plaintiffs’ account as it would be regarded as an illicit earning by the Bank with parties ordered to do a reconciliation of the impugned loan within six months.

The Judge also dismissed Stanbic Bank’s Counter claim as arising from an illegality and condemned the defendants to Costs with parties directed to implement the Orders of Court.

The conclusion of this embarrassing legal tussle which has lasted over four years, legal minds we contacted for purpose of this story, say that Abunyang is now a trespasser and his continued occupation of the suit property is in contempt of Court which will instigate further legal suits against him and forceful eviction from the impugned suit property.

![]()