The Generating Growth Opportunities and Productivity for Women Enterprises (GROW) Project is under intense scrutiny following concerns about the under-absorption of allocated funds and uneven distribution across the country.

A recent Auditor General’s report for the financial year ending June 31, 2024, revealed that only Shs18.52 billion of the allocated Shs75.1 billion had been spent, leaving a significant balance of Shs56.6 billion unspent. This imbalance raised questions about the project’s efficiency and its ability to meet the needs of its intended beneficiaries.

The unspent funds have reportedly affected the distribution of credit to financial institutions participating in the project, which were supposed to offer financial support to women entrepreneurs. The report, however, notes that project management has implemented several measures, including collaborations with key partners, to improve the implementation process and fund absorption moving forward.

Concerns about the project were highlighted during a session of the Public Accounts Committee (PAC) – Central Government, where MPs analyzed the performance of the GROW Project. Hon. Susan Amero (Independent, Amuria District Woman Representative) raised concerns over the fund distribution, particularly in Northern Uganda, where she noted that much of the money was concentrated in Lira City, leaving other districts, such as Alebtong and Amuria, with no funding.

“When you go to districts in Northern Uganda, you will find that a lot of money is spent within Lira City and not the other districts. In Alebtong and Amuria districts, the money has not been received. So, where is our share?” Amero asked, highlighting the regional disparities in fund allocation.

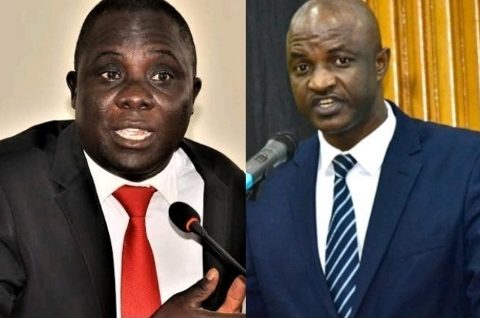

MPs also expressed concerns about the requirements for women to access the funds. Hon. Joseph Ssewungu (Kalungu West County) questioned whether the World Bank’s funding requirements were realistic and aligned with the financial capabilities of the women in need.

“If you compare the number of women who have registered in different areas to get this money, all of it should have been disbursed by now. When negotiating with the World Bank, did you align their requirements with what women can afford?” Ssewungu said.

Meanwhile, Hon. Naboth Namanya (FDC, Rubabo County) raised concerns about the role of participating financial institutions in the project, alleging that some banks were delaying the disbursement of GROW funds while pushing applicants to take out loans on their own terms.

“What is important now is to superintend over participating banks. Banks tend to get the appetite of giving their own loans while delaying to release the GROW money. They advise applicants to take their options while telling them that the GROW money is not available,” Namanya stated.

In defense of the project’s progress, Dr. Ruth Aisha Kasolo, the GROW Project Coordinator, explained that six banks, including Centenary Bank, Finance Trust Bank, Post Bank Uganda, DFCU Bank, Equity Bank Uganda, and Stanbic Bank Uganda, were allocated Shs50.1 billion for the first year of the project. She attributed the under-disbursement to the project being in its early stages, with agreements with the banks signed late in the financial year.

“The under-disbursement was because the project was in its initial stages of implementation. The agreements with the six participating banks were signed towards the end of the year under audit. So we received and paid money to beneficiaries in this current financial year,” Kasolo explained.

As of December 31, 2024, Kasolo reported that 2,175 women in 84 districts