BoU lead counsel Margaret Kasule and her team are in what one would term as catch 24! because look, having signed a decree at the Court of Appeal on August 6, 2020, in which they obliged to pay in billions of shs, the legal costs for their victims Dr.Sudhir Ruparelia, the majority shareholder in the defunct Crane Bank Ltd and Meera Investments, they’ve since shifted gears and on Tuesday told the supreme court, where they ran to appeal after they lost in all lowers courts, that it’s instead Crane Bank Ltd (In receivership), which ceased to exist on January, 20, 2018 to pay for legal costs!

Now, BoU themselves signed a legal document on the above date (January, 20, 2018) acknowledging that Crane Bank (in receivership) no longer exists from the date of signing, but yet on the other hand, they want a non-existent entity to pay a law suit that was filed, not by CBL (in receivership), but by BoU!

BoU, in this classic scenario here, can best be likened to a witch doctor who sends his client (patient) to bring a python’s horn or a fat cock with teeth, if he/she wants the `charms’ to work well on his/her `illness’, well knowing that there has never lived any of the above on planet earth! So is the witch doctor being honest to his ‘patient’? And do you think the witch doctor truly has a remedy for this helpless ‘patient? Your answer is as good as mine.

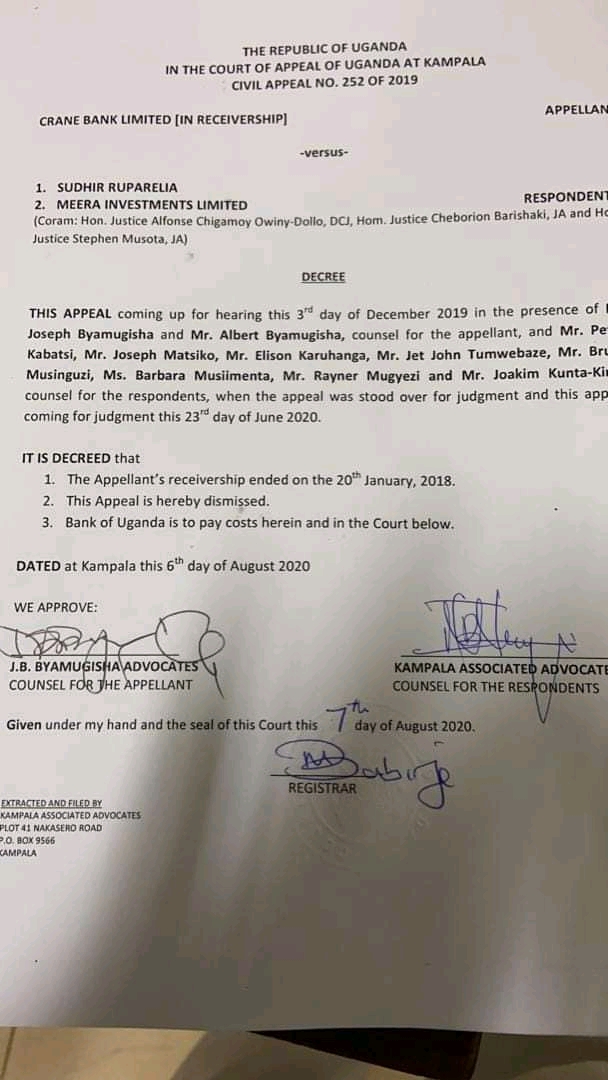

“It’s Decreed that;

1-The applicant’s receivership ended on the 20/Jan/2018 .

2-This appeal is hereby dismissed

3-Bank of Uganda is to pay costs herein and in the court below” read part of the decree BoU lawyer JB Byamugisha signed on behalf of their client.

Here is the..

Respondents-notes-on-the-NOtice-of-Withdrawal-civil-appeal-no-7-of-2020

Now, yesterday, the same lawyers who signed the above decree came to the supreme court in Kololo talking completely a different language altogether, which sent the five quorum honourable justices into early day’s retirement, ordering that they would soon make a ruling on the same on notice.

Bank of Uganda in 2020 was prompted to forward the fraud case of Crane Bank to the Supreme Court after both the High Court and Court of Appeal ruled in favour of Kampala businessman Sudhir Ruparelia.

The appellate court dismissed the case filed by Crane Bank Limited (in Receivership) vs. Sudhir Ruparelia and Meera Investments Limited as the former tried to recover assets it says the Ruparelias swindled while they owned the defunct bank.

In their rulings however, both the court of the first instance in the case (High Court) and the Court of Appeal, reasoned that Crane Bank was not capable of suing or being sued the moment it ceased to exist.

In its decree, the Court of Appeal informed lawyers from both sides that the Appellant’s receivership ended 20th January 2018 thus dismissing the appeal and ordered BoU to cough billions to Sudhir for wasting his time in endless court battles.

However, BoU Governor Mutebile and his legal team seemed not satisfied thus pushing matters to the Supreme Court saying that receivership does not take away the corporate personality of a company which includes the right to trace and recover assets and the right to sue for those assets.

Governor Mutebile said that neither the High Court nor the Court of Appeal considered or took a decision on the claims for wrongful and illegal extraction of funds from Crane Bank.

“The implications of these judgments are that a Receiver of a financial institution/bank cannot pursue or seek recovery of assets of a bank in receivership by way of legal proceedings,” Mutebile said.

He added that “The judgements also set a precedent that limits the Central Bank’s capacity to resolve banks in a manner that ensures accountability for mismanagement of depositor funds and promotes good corporate governance in the banking industry.”

However, as the Supreme Court was preparing to decide on the appeal, last month the ‘dramatic’ BoU resurfaced with a letter seeking permission to withdraw the appeal which actually left many thinking that BoU had discovered its faults and was ready to pay the workaholic Sudhir only to find out that this was a trick to evade court costs.

So now, finally, the Supreme court is set to deliver its ruling on that application but Sudhir has revealed that he has objected to the BoU’s `deal’ to withdraw the appeal insisting that the case must either continue or Court should compel them to pay costs.

“BoU is saying Crane Bank in receivership should pay costs, but remember Crane Bank ceased to be in receivership on January 20,2018 and went back to its shareholders, so when you say Crane Bank should pay costs, BoU is simply saying that we should pay for our selves, yet it’s them (BoU) who took us to court and lost in all the two lower courts before they ran to Supreme Court. So now they don’t want to pay the costs,” Sudhir told the press yesterday at Supreme Court Kololo, a leafy Kampala suburb.

Do You Know How It Started? Worry Not..

BoU /Crane Bank in Receivership had sued Sudhir and Meera Investments Limited for allegedly fleecing Crane Bank Limited (CBL) of Shs397 billion which the Central bank wanted to be refunded.

Previous Rulings

In previous court rulings, BoU said that the decision of shutting Crane Bank was necessary upon discovering that it had significant and increasing liquidity problems that could not be resolved without the Central Bank’s intervention, given that Crane Bank had failed to obtain credit from anywhere else.

An inventory by external auditors found that the assets of Crane Bank were significantly less than its liabilities. In order to protect the financial system and prevent loss to the depositors of Crane Bank, Bank of Uganda had to spend public funds to pay Crane Bank’s depositors,” Mutebile said then.

However, tycoon Sudhir denied the allegation thus counter-suing BoU, seeking compensation of $8m (Shs28 billion) in damages for breach of contract.

He asked the High Court to dismiss the case arguing that the Central Bank overstepped its mandate in commencing court proceedings against him and his Meera Investments Company.

Presenting an objection against BoU, Sudhir through his lawyers Kampala Associated Advocates, told Justice Wangutusi that when dissolving a bank, BoU had three options including putting someone else in its management — what is termed as statutory management, receivership or liquidation.

Counsel Elison Karuhanga a lawyer at Kampala Associated Advocates, argued that however, BoU chose to go for receivership yet under the law, specifically only the manager and the liquidator of the said bank is mandated to file a suit and not a Receiver.

He further explained that BoU as a Receiver could only dissolve or sell Crane Bank within 12 months but not sue its managers.

Full Genesis Of The Case

On June 30, 2017, Crane Bank Limited (in Receivership) took Mr. Sudhir Ruparelia and his Meera Investments Ltd. to court for causing financial loss amounting to UGX 397 billion to Crane Bank in fraudulent transactions and land title transfers.

Crane Bank (in receivership) in its Civil Suit No. 493 of 2017 sought High Court to compel Mr. Ruparelia to pay back the US$80,000,000, US$9,270,172.00, US $ 3,560,000.00, US$990,000.00 and UGX 52,083,995.00 as compensation for breach of fiduciary duty.

While Hon. Justice Wangutusi dismissed the UGX397 billion case against Mr. Ruperalia on a technicality, alleging that Crane Bank (in Receivership) lost its powers to “sue” and to “be sued”, thus rendering its suit a nullity, Crane Bank (in Receivership) maintaining that receivership is a management situation, and hence no legal change as to the capacity of a company to sue and be sued.

![]()