President Yoweri Museveni has ordered the controversial Uganda Retirement Benefits Regulatory Authority (URBRA) to get off workers’ savings in the National Social Security Fund (NSSF).

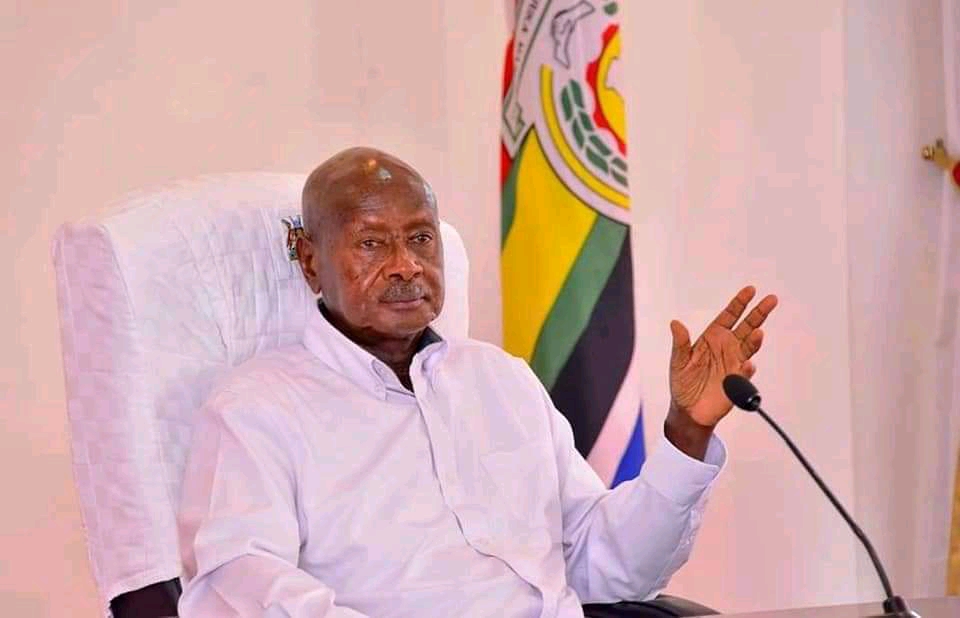

Museveni made the directive during a meeting with stake holders of the NSSF fund at State House Entebbe on Tuesday.

The meeting was attended by among others, the Prime Minister Robinah Nabbanja, the Finance Minister Matia Kasaijja, NSSF-MD Richard Byarugaba, Minister for Gender Labor and Social Development Betty Amongi, government Chiefwhip Thomas Tayebwa and MPs for workers and special interest groups.

During the meeting, stake holders noted that they were disappointed with the way business was being run between Ministry of Finance and URBRA.

“We do not understand why URBRA should be taking Shs7billion from NSSF money just to do regulation. This money is not only too much but it should not be given to them,” one of the MPs said.

“URBRA is a body that has been set up by members from Ministry of Finance to siphon money, they are recruiting their colleagues to the authority to partake of the workers’ money without doing anything,” another MP noted.

Museveni in reply expressed that he was also wondering why a body constituted by government would be using money from workers to pay its employees.

“This is not a negotiation issue; it is about what can safe guard this money. URBRA should be paid by government not by workers money. URBRA is adding costs to workers. If you create an agency, pay it. They should not take any other money from NSSF. They should remove all these people from workers money,” he said.

Museveni maintained that members of URBRA are not well vetted, however ordered the authority to be completely restructured such that only those on merit are hired.

“People there are being recommended on friendship basis, this must stop. Those who are in charge of workers’ money should have an experience and knowledge in managing money,” Museveni said.

Infact, this was the final contentious issue between the workers representatives, the Ministry of Gender, Labour and Social Development and the Ministry of Finance, Planning and Economic Development that has delayed the passing of the NSSF bill.

The Bill will see contributors aged 45 and above have 20% mid-term access to their savings while the People living with disabilities will also access up to 50% of their savings if they are 40 years and above, have saved for ten years and are out of a job or are unemployable.

Mid-term access provides for additional benefits and relief to members of the Fund before they reach the age prescribed by the law. Section 12 of the NSSF Act was amended to provide for dual supervision of the Fund. Ministry of Gender will be in charge of the social security arm of the Fund, which deals with the welfare of workers and their savings while Ministry of Finance, Planning and Economic Development will supervise the Investment arm of the Fund, which deals with the business component where savings are invested in assets to generate income.

President had initially suggested supervision by the Bank of Uganda and the Ministry of Finance Planning and Economic Development since they specialise in dealing with finances but BOU was ruled out technically.

On the issue of whether or not the Managing Director of NSSF who is an ex-official has a right to vote, the president agreed that the Managing Director can be a member but with no vote.

“The character can just sit there and talk. He can be a member but doesn’t vote. There are things which are dangerous which can either fail or kill the institution,” he said.

On the issue of mid-term access of 50% for persons with disabilities, Museveni agreed with the proposal of people with disabilities of 40 years and above who have saved for ten years can access 50% of their savings mid-term but added that the law must be very clear on who is disabled.

He cited an example of a councilor in Mbarara, a one Karubwende who looked perfectly normal but was representing people with disabilities. When asked what her disability was, she said she was disabled in a ‘very private place’ and was left to serve for a long time.

The NSSF MD Richard Byarugaba said while they have no data on people with disabilities so as not to discriminate, the numbers are not significant and members can be paid.

According to the workers records, there are 2,000,000 people saving with NSSF and less that 0.1% about 20,000 people are living with disabilities.

The NSSF fund has grown from a paltry Shs 800 billion with less than 500,000 savers when the NRM government came into power in 1986 to a Shs 17trillion fund and over two million savers and growing making it one of the best on the continent

![]()