East Africa’s finance ministers on Thursday tabled a raft of measures for expanded expenditure plans for the 2024/2025 fiscal year with a keen eye on debt repayment and reliance on domestic revenues to run government operations.

These measures effectively set the stage for increased taxation, which will potentially choke economic growth in the region.

East Africa’s economic growth is projected to pick up from 3.5 percent in 2023 to 5.1 percent in 2024 and 5.7 percent in 2025, according to the African Development Bank, buoyed by infrastructure development and increased regional trade.

Recently, traders across the region were up in arms against heavy taxation by the ruling regimes that are hard-put to fund burgeoning budgets amid a cash crunch caused by debt servicing and slowing economies.

The governments of Kenya, Uganda and Tanzania have proposed a raft of tax proposals aimed at generating more revenues despite protests from taxpayers. In Uganda, the business community has been fighting off efforts to levy additional taxes to achieve its Ush30 trillion ($7.87 billion) target for the upcoming financial year.

The Treasury is facing a cash crunch to meet both its current budget deficit and its upcoming 2024/25 fiscal year budget.

The government needs an extra Ush5.64 trillion ($1.48 billion) to fund its Shs58.3 trillion ($15.3 billion) budget for the fiscal year 2024/25.

But the taxman says top taxpayers are disappearing, arrears are growing, and traders are contesting a remittance of value-added tax.

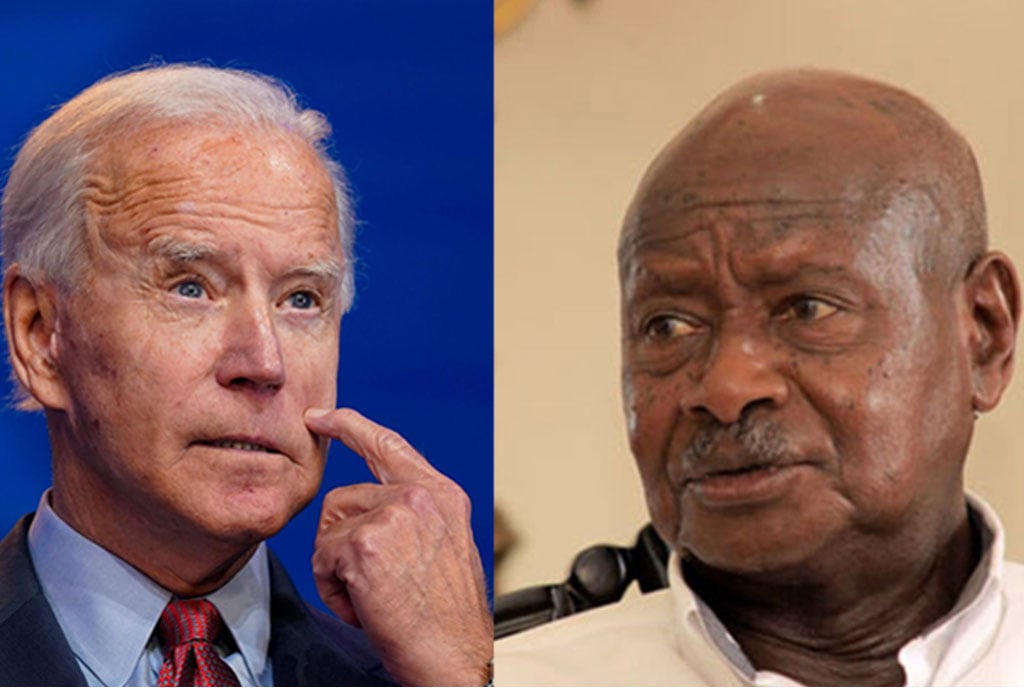

The country finds itself in a tight corner after the World Bank’s decision to stop issuing new concessional loans over the anti-gay law passed last year.

Uganda’s option is taxing its citizens. The new tax bills in parliament seek to increase tax on building materials, fuel, fresh juice, mineral water, opaque beer, and profits from the sale of company stock.

Henry Musasizi, Finance state minister, presented five tax bills to parliament, saying the government plans to use the proposed taxes to raise Ush1.9 trillion ($498.66 million).

“The government is between a rock and a hard place. It’s disturbed by a low tax base. There are a few things that it can tax, but it needs efficiency in its tax collection so that its efforts for more money don’t instead hurt its people,” said Prof Augustus Nuwagaba, an economist.

According to Shirley Kongai, chairperson for policy advocacy at the Private Sector Federation of Uganda (PSFU), taxes make up between 45 percent and 55 percent of the cost of finished goods.

Among the proposed tax bills is the Income Tax (Amendment) Bill 2024, which would impose a five percent tax on gains from the sale of non-business assets such as purchase shares of listed companies, which the Capital Markets Authority has termed bad because it would affect the stock market due to low liquidity and the exit of foreign investors.

“We believe it is against the principles of taxation — to tax where a person has not been earning income from the assets,” said Institute of Certified Public Accountants of Uganda.

“The proposed amendment in its current form is anti-investment and will prevent people from investing and accumulating assets.”

The other proposal, found in Clause 5 of the Value-Added Tax (Amendment) Bill, 2024, states that if an employer provides goods or services, tax authorities will consider it as a part of the employee’s business activities, and the employer will account for it through an 18 percent VAT.

The real estate sector is already grappling with financing. Banks don’t want to lend it because of the associated loan defaults and low occupancy rates, and the few that do charge the developers high-interest rates of above 20 percent.

Meanwhile, traders strike has spread countrywide, protesting the cost of implementing the Electronic Fiscal Receipting and Invoicing System. A trader would need a computer or smartphone, a printer and an expert to help file the taxes. They need to pay $654 integration fees.

When Rwanda rolled out a similar programme, the government absorbed some of the costs.

This week, at least 30 trucks from Kenya, loaded with tonnes of Irish potatoes destined for Uganda, were stuck at the Busia border after Uganda Revenue Authority (URA) doubled withholding tax on products from the neighbouring country.

Irish potato importers from Kenya said they have been paying withholding tax of Ush120,000 ($31.49) for each truck, but URA currently seeks Ush1,200,000 ($314.94) from each truck in the new tax policy. The tax body however denied this.

Another 20 trucks were reportedly impounded by the tax body in Jinja on April 12, when the new withholding tax policy was implemented.

Traders have kept their shops locked after talks with the government yielded no results. They were scheduled to meet President Museveni on Friday.

The closure of shops in Kampala for more than a week paralysed business.

In Kenya, President William Ruto’s administration is pursuing aggressive fiscal policy tightening to lift the country from a debt trap and shore up its finances through multiple taxes and levies.

The policy stance, which has provoked public outrage across the country, has pushed the economy to a crossroads on key issues, including whether an increase in taxes will automatically translate into higher government revenues and spur economic growth without hurting consumers and businesses.

Tightening fiscal policy increases tax rates and reduces government spending thereby reducing the purchasing power of consumers and businesses, while a loosened fiscal policy increases aggregate demand directly through a reduction in tax rates and increase in government spending.

Tax experts at the consultancy firm Ernst & Young (EY) say increasing taxes and reducing government spending is counterproductive and will translate into reduced investment and economic activities.

“Increasing taxes could potentially address some of these economic challenges such as reducing budget deficits and providing funds for public investment. However, it could also have adverse effects like reducing consumer spending, discouraging investment and exacerbating poverty if not implemented judiciously,” EY said.

The government is spending over 90 percent of its tax collections to service debts and pay salaries for civil servants effectively creating a need for more borrowing. The increased taxation measures have eroded the spending power for consumers and businesses and left the Kenya Revenue Authority (KRA) struggling to meet its revenue collection targets.

In Tanzania, the state is looking increasingly towards raising the domestic financing component of its annual budgets and cut down on external borrowing in the wake of growing tax collection figures over the past three years.

The country’s Tsh49.34 trillion ($19.35 billion) budget estimate for the 2024/2025 financial year includes a 10 percent increase in domestic financing from the 2023/2024 budget.

The new domestic revenue target has been set at Tsh33.26 trillion ($13.04 billion) which will constitute 70.1 percent of the total budget, up from 60 percent (Tsh30.23 trillion/$11.85 billion) in the preceding year.

In his budget guidelines presentation to the National Assembly on March 11, Finance Minister Mwigulu Nchemba projected that income from tax collections through the Tanzania Revenue Authority would total Tsh29.85 billion ($11.7 billion) in the next fiscal year, an average of Tsh2.48 billion or just under $1 million per month.

This follows a steady trend of monthly TRA collections exceeding Tsh2 billion ($784,300) since August last year, hitting an all-time high of Tsh3.05 billion ($1.19 million) in December 2023.

In January, February and March this year the agency recorded tax revenues of Tsh2.12 trillion ($831,300), Tsh2.02 trillion ($792,100) and Tsh2.48 trillion ($972,500) respectively, taking the total for the fiscal year to Tsh18.4 billion ($7.21 million).

Dr Nchemba told parliament in early March that the strategy going forward would be to keep expanding the tax base, improving the environment for voluntary tax compliance, and “strengthening the administration of tax laws to solve the challenges posed by tax evasion.”

He also mentioned plans to encourage more use of ICT systems to collect taxes in the land and real estate sectors.

![]()