The commercial division of the High court in Kampala has issued a four-day interim order restraining the Uganda Revenue Authority (URA) from enforcing the implementation of digital tax stamps.

The development comes after Muwema and Company Advocates, acting on behalf Sylvester Kamuli went to court challenging the implementation of the digital tracking solution (DTS) currently being implemented by the tax body.

The order signed by the deputy registrar, Dr Agnes Nkonge stays URA from enforcing the transition period deadline which the tax body had set before slapping heavy fines on manufacturers and importers of several gazetted goods including bottled water, soda, beer, wine, spirits, and tobacco.

Nkonge also warned that the interim order shall remain in force until February 4, when the main application shall be heard. The implementation of the digital stamps which was meant to affect most of the companies manufacturing drinks was supposed to commence February 1.

URA spokesperson in charge of corporate affairs, Ian Rumanyika says that the authority is not aware of the said court order.

“We haven’t been served with it (the court order). when you serve a client you get a received copy. This document we see on social media is not with us. our efforts continue,” he says.

Effective the Financial Year 2019/2020, URA announced the implementation of digital stamps on beers, sodas wines and other soft drinks with an aim of combating illicit trade, seal revenue leakages and boost collection and increase efficiency in managing taxpayer compliance.

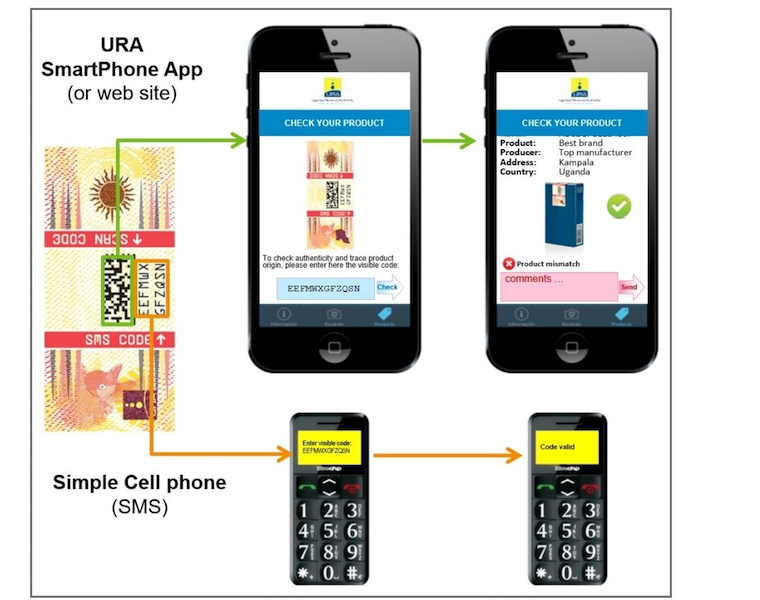

In addition, URA observed that the system which is already being implemented in Kenya and Tanzania could also enable manufacturers, distributors, retailers, and consumers to conveniently verify and trace all specified goods throughout the distribution chain.

In October, the Alcohol Association of Uganda and, 38 manufacturing companies led by Nile Breweries Limited (NBL) ran to court seeking to block the implementation of digital stamps arguing, among other issues, that the actions to launch and enforce the digital tracking systems pursuant to the Tax Procedures Code (Tax Stamps) Regulations, 2018 is illegal and therefore unenforceable.

But, on November 5th, 2019 Justice Musa Ssekaana of the civil division of High court dismissed their application arguing that courts cannot grant an injunction which will have the effect of suspending the operations of the legislation.

Previously, the implementation of the digital stamps was delayed by a shortage of resources after parliament queried more than the Shs 103 billion URA needed to conduct the implementation.

URA insists that although Uganda’s soda and bottled water sector currently consists of 256 manufacturers, only 46 are on the tax register which lowers the potential of collecting over Shs 14.4 trillion in tax per annum given the fact that companies produce over 231.4 billion bottles per annum whose unit price is placed at Shs 625 per bottle.u.r.n

![]()