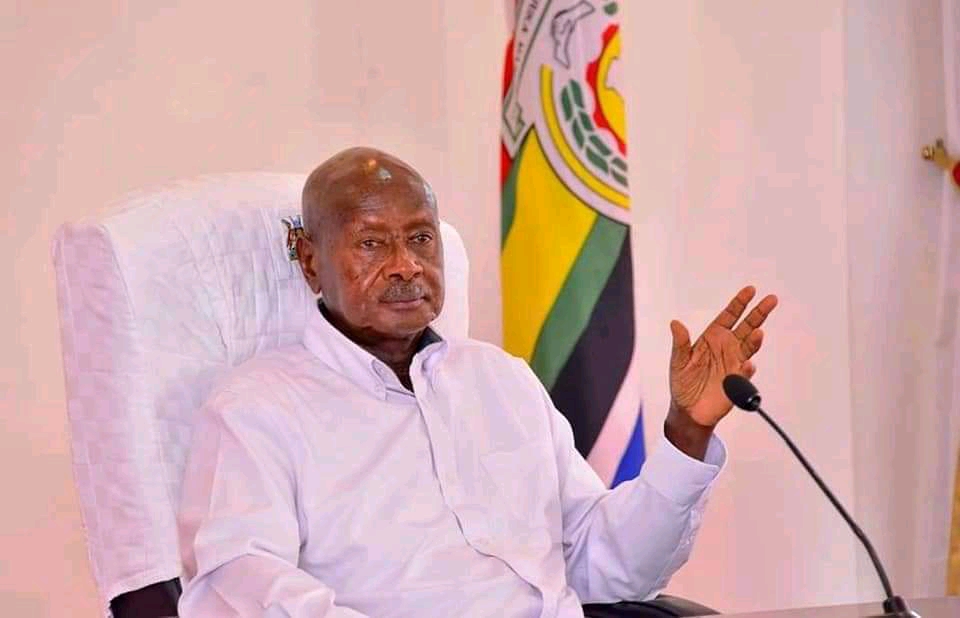

In a way of emphasis on bank loans, President Yoweri Museveni has said banks must not count days when people have not been working to service active loans. Millions of Ugandans in both the formal and informal sectors are currently not working as a result of the government’s measures to control the spread of coronavirus-COVID-19.

Bank of Uganda had already directed banks to restructure loans and give people a holiday of up to 12-months but on a case by case basis.

Museveni, who extended the lockdown for more 21 days up to May 5, 2020 said that the government will discuss with the banks to ensure that people aren’t forced to pay for the period they weren’t working.

While this is a reprieve to the borrowers, it will mean banks must absorb losses that come with such a directive. It literally means banks will freeze things like interest counting during this period of the lockdown. By May 5, 2020, the lockdown period will have reached five weeks.

BoU also said commercial banks should not pay dividends to their owners and bonuses to their bosses to remain with enough cash to absorb losses that come with this period. Already, some banks have announced they are giving customers a holiday in the payment of their loans as many are likely to default due to coronavirus that has shut down the economy.

Stanbic bank, Absa Uganda and Centenary bank have said their customers should reach out to them for help. Absa said in a statement on Monday that customers would get up to 6 months of a holiday but on a case by case basis which means not everyone will get.

With the economy not functioning fully, it is expected that many people and business will default on their loan obligations. This fear is compounded by the fact that the economy will grow the slowest rate in recent times at 3 percent according to the Bank of Uganda. Restructuring the loans is a way to help customers carry on.

Other than loans, banks have also announced sweetheart deals including free withdrawals on small amounts in public relations stints to show customers they care. Dfcu, Absa, Stanbic and Centenary bank have announced free cash withdrawals at ATMs and agents. Most banks have limited free withdrawals to just 50,000 Shillings.

Paul Lakuma, a researcher at the Economic Policy Research Centre said the central bank can de-regulate a little bit by for instance reducing on the liquidity ratio requirements for banks. This means they can have more money on themselves to either give out or help cover gaps from restructuring customer loans.

Lakuma warns however that BoU supervision should be a little tighter so as not to end up with failed banks soon.

Lakuma also praised the central bank’s directive that banks suspend the payment of dividends to owners and bonuses to managers. This means they will have more money to absorb losses that might be incurred as a result of likely loan defaults.

***URN***

![]()