Kampala: As the old adage, there is no smoke without fire can be interpreted to mean that every rumour or talk has a source.

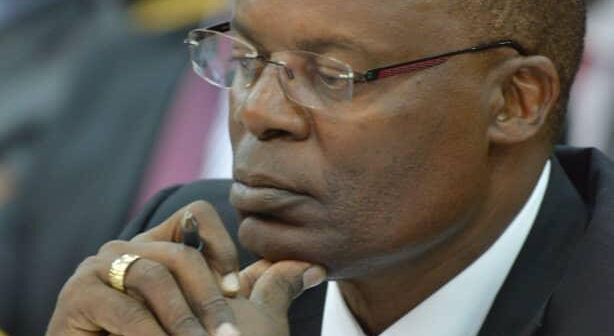

This saying can be applied to the former troubled Bank of Uganda deputy governor, Dr Louis Kasekende whose name had become a ‘season in season out’ fixture on the table of scandals and controversy at the Central bank not forgetting the widely reported sabotage and undermining the authority of the governor, Prof Emmanuel Tumusiime Mutebile.

That notwithstanding, the bank’s operations had caused trouble to both Tumusiime-Mutebile and Kasekende who was at the centre of the scandals, he being the overall supervisor of the officers carrying out the operations such as the supervision of banks, printing and transfer of currency notes to upcountry branches, as well as destroying of old notes.

The wings of the negative effects of his work had been of late felt across the banking sector and the economy with the reckless donation of the defunct Crane Bank limited to dfcu bank at a paltry credit of Uganda shillings 200 billion. This scandal paralyzed the sector.

Kasekende was the acting governor during the period when Crane Bank was under receivership, and was the direct supervisor of Justine Bagyenda, the sacked former executive director of commercial bank supervision at BoU when the nasty act of selling crane bank happened.

The operations such as the closure of seven commercial banks resulted into the probe of BoU by parliament. It unearthed gaps in the way how top BoU staffs were running their duties.

The probe made the public to ask how some of the officials at BoU got the jobs. While he tried to block the forensic audit directed by parliament, the interim audit report by the auditor general revealed that 25 certified land titles of former GTB clients are missing and assets worth Uganda shillings 23 billion can’t be accounted for.

The closure of banks like Teefe Trust Bank, Greenland Bank, International Credit Bank, Cooperative Bank, National Bank of Commerce, Global Trust Bank Uganda in 2014 and Crane Bank Limited (CBL) exposed Kasekende and the former executive director of bank supervision Justine Bagyenda as being unprofessional and careless as they did not follow some procedures and guidelines for the closure of banks. The banks were closed for allegedly being undercapitalized.

This calculation made Kasekende unsuitable to replace Tumusiime-Mutebile. Worse still BoU failed to account for Shs290 billion of the money injected into CBL as liquidity support.

Further Kasekende and others allowed MMAKS Advocates to act as transaction lawyers in the sale of CBL assets, the lawyers earned billions of shillings, yet the transaction process was questionable. Kasekende and Director Legal Margaret Kasule took the biggest share of the blame here.

The two above officials would still go ahead to select MMAKS Advocates as their external counsel in the case involving Ruparelia Group well knowing they had worked for Sudhir Ruparelia and some of his companies. Court dropped the lawyers from Shs397 billion BoU/Crane Bank In Receivership case. But the taxpayer lost again in terms of legal costs.

That meant that BoU had to look for other external lawyers, further making the taxpayers incur more legal costs. Worse still court recently ruled that Crane Bank In Receivership could sue, awarding Sudhir and Meera Investments Limited costs of the suit. It is the taxpayers to pay that money.

Yet the recent alleged printing of Shs90 billion not yet recovered was also blamed on Kasekende. Also the recent scandal where officials stole old notes was blamed on Kasekende as the overseer of operations in BoU.

If he was trying to cover up his culpability, only time can tell as the days of a thief are always numbered, and most times 40!

Kasekende’s controversy and worst scandals

The horrible disliked mobile money tax taking into the account that the bill was sent back to parliament for debate. Bank of Uganda like any other stake holder appeared before the budget and finance committee of parliament to give its position on the tax on August 1st 2018.

When government bodies were expected to tow the government position, Dr Charles Abuka the BoU’s director for statistics seemed to flatly reject the tax sending signals of lack of coordination among the public including the ministry of finance.

As reported in the media, Abuka had passed by Kasekende’s office before going to parliament. I hope one is able to read between the lines. As a consequence, the governor was summoned for a meeting at the Ministry of Finance planning and economic development on August 3rd to explain this contradiction.

Secodly, the organizational structure at Bank of Uganda placed Kasekende to be directly in charge of key areas such as; finance and administration, operations and others. This gave him leverage to micro manage the institution and exert undue influence over many bank officials but also enabled him to disregard established procedure at the bank.

For instance, Bank of Uganda advertised for qualified people to fill the vacancy of the legal clerk. While interviews were conducted, reliable reports proved that his hand loomed large over the recruitment process as per the interviews that were conducted on July 27th 2018. The outstanding candidate was given a suspiciously poor score prompting a written protest from the Isaac Bony Teko, the deputy legal.

However, Kasekende and Oketcho, the director for administration ratified the questioned process and results. The internal audit department at BoU investigated the process.

The power blackouts at the Central Bank, discontent among employees who were sidelined in promotions and failure to follow proper procedures of human resource management at the central bank are controversies that Kasekende preside over as he oversaw operations and administration.