Due to the continued refusal by the manufacturers to pay for the tax stamps, Government of Uganda (GoU) is looking at Shs 340 Billion Shillings to be paid to SICPA a company it out sourced to supply the Digital Tax Stamps.

This means that 1 billion per day of tax payer’s money will be allocated to payment for this software and a total of 3 trillion has to be paid for the procurement of these stamps in 5 years.

According to Clause 6.1 submitted in the contract drafted between Uganda Revenue Authority and SICPA SA, the manufacturers, producers and retailers who are the procuring entity were to pay the service provider that is SICPA SA the following amount in Uganda Shillings per unit.

Water 15 Ugshs, Soda 20 Ugshs, Beers 55 Ugshs, Spirits 240 Ugshs, Wines 200 Ugshs and Tobacco 110 Ugshs VAT exclusive.

Uganda Manufacturers now want the Government to continue footing the bill of the Digital Tax Stamps due to the threat that is posed by the COVID- 19 pandemic.

The initial idea was that there was no cost to the solution but rather a revenue sharing agreement that would pay back all investment to stake holders. This would bring the costs of the Digital Tax Stamps down considerably within the range of our neighbouring countries.

Gov’t have already approved Digital Tax Stamp Solutions which will cost tax payers over 1billion each year

What does this mean for business?

The cost of additional stamp duty on local products will make it difficult for Government of Uganda to uphold its import substitution agenda as the alteration in costs for locally manufactured goods will be minimal.

The fact that SICPA is the sole operator and producer of the stamps makes the Government of Uganda at the mercy of the service provider to fulfil a critical element for excise duty management since all stamps will have to be pre ordered and this could obstruct operations of traders and manufacturers.

The burden of payment will therefore be placed on the local manufacturers, distributors and retailers which will lure them to illicit trading activities for a cheaper solution.

The tax stamps were also procured by neighbouring countries such as Kenya and Tanzania.

Kenya Revenue Authority which also procured the same Digital Tax Stamp Solution is paying 0.5 Kshs per stamp for water which is approximately 17 Ugshs and 0.6 Kshs for other beverages which is approximately 20 Ugshs.

This shows how Uganda has highly priced the stamps on excisable goods bringing about an increase on manufactured and imported goods.

Digital Tax Stamp Solution Background In Uganda

In a scheme to combat illicit trade, seal revenue leakage, boost collection and increase efficiency in managing tax payer compliance, URA introduced Digital Tax Stamps in Uganda.

The Digital Tracking Solution is intended to monitor and control the production and importation of all excisable goods such as Beers, Cigarettes, Water, Wines, Soda and Spirits and to give URA data to ensure and verify fair taxation of all products that are subject to the taxation exercise.

The introduction of these stamps is to enable manufacturers, distributors, retailers to conveniently verify and trace all specified goods throughout the distribution chain thus increasing government revenue and fighting counterfeit products on the market.

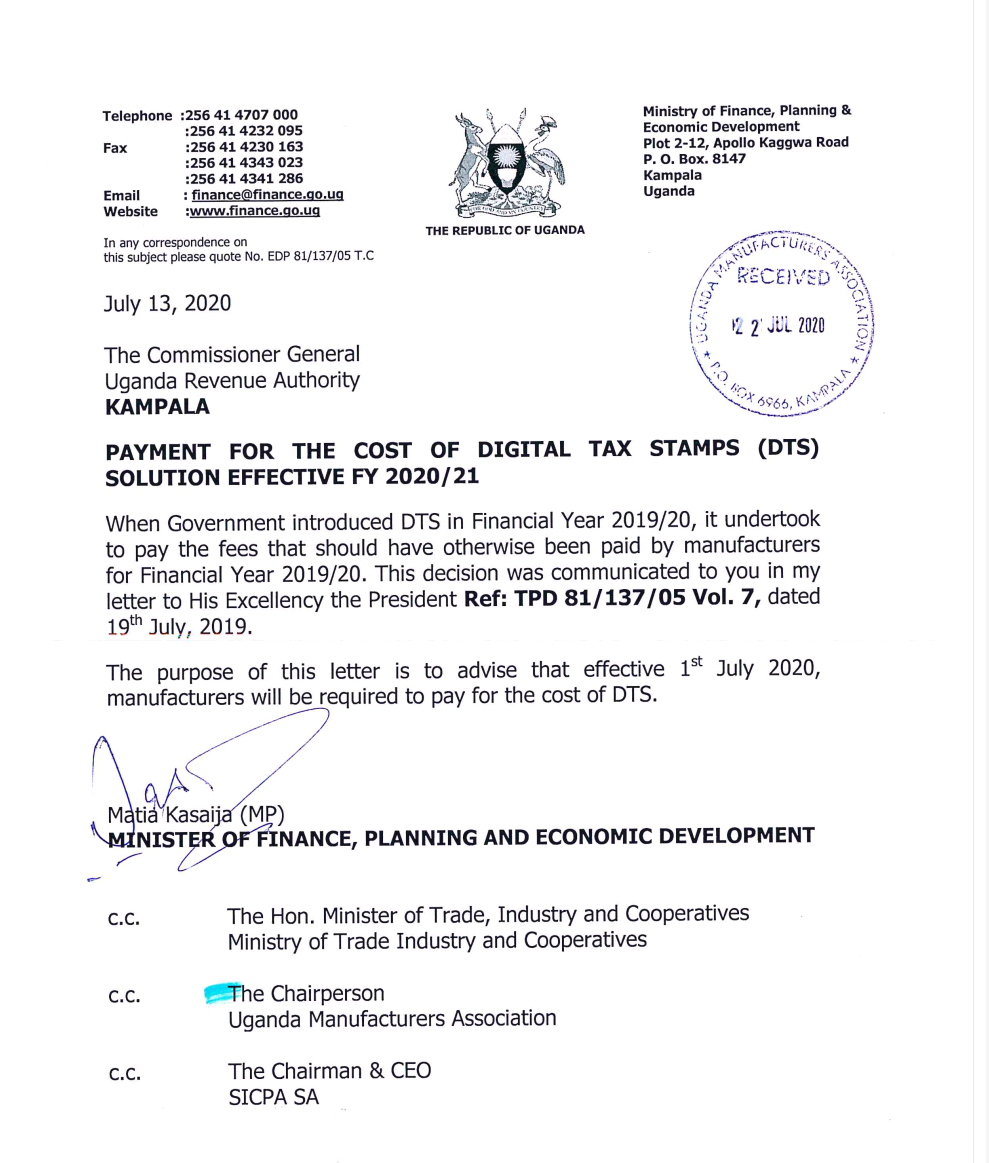

The government last year single sourced a Swiss Company, SICPA, and rolled out the new system in November, with the promise to meet the cost for one year.

The tax is said to be levied as follows Water 15 Ugshs, Soda 20 Ugshs, Beers 55 Ugshs, Spirits 240 Ugshs, Wines 200 Ugshs and Tobacco 110 Ugshs VAT exclusive.

In a letter dated May 22, signed by Uganda Manufacturers Association Executive Director, Daniel Birungi, addressed to the Minister of Trade Industry and Cooperatives, Amelia Kyambadde, UMA says the government should continue footing the DTS bill as a form of stimulus package given that the future of business growth is unclear due to COVID-19.

The manufacturers have insisted that the Government should continue footing the bill on their behalf due to the uncertainty that was brought about by the pandemic.

The Digital Tax Stamps cost 3 trillion which is to be paid in 5 years therefore the government will have to pay 340 Billion per year to SICPA for the tax stamps.