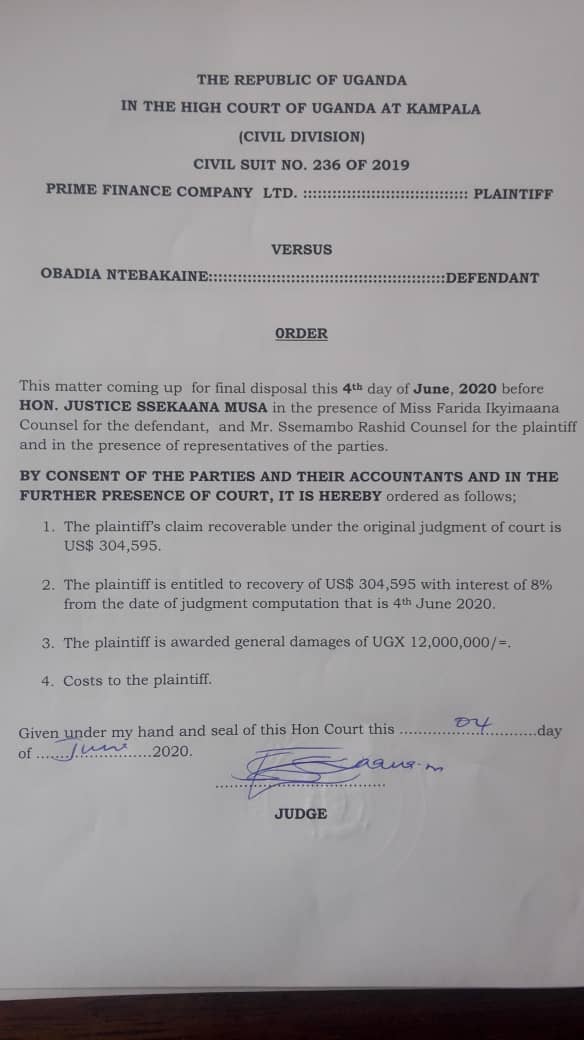

High Court in Kampala has ordered for the re-arrest of businessman Obadia Ntebekaine for failure to pay Prime Finance 304,595 US Dollars and Damages of 12Million shillings.

Businessman Obadia Ntebekaine was dragged to the High Court by Prime Finance Company over his failure to pay $3.2million (sh11.8billion) in a case dating way back in 2008.

According to documents this website has landed on, both parties in 2019 agreed on the amount to be paid but Obadia Ntebekaine has since breached the agreement and varnished in thin air.

Background

Prime Finance filed a suit seeking for orders against the defendant (Ntebekaine) to pay a sum of USD 3,071,681, a declaration that the defendant is in violation of the plaintiff’s economic rights enshrined under Article 40 (2) of the Constitution of the Republic of Uganda, Special damages, General damages, Costs and Interest therein.

The parties entered into a loan agreement whereupon the defendant borrowed USD 200,000 (United States Dollars Two Hundred Thousand) for a period of two months and thereafter, the defendant issued a postdated cheque dated the 27th of November 2008 amounting to USD 211,062 (United States Dollars Two Hundred and Eleven Thousand Sixty Two cents) as repayment over the said loan period covering the principal and interest of the same.

It was agreed that in the event that the defendant fails to pay the said loan within the agreed timelines, he was to continue repaying the loan at an interest rate of 0.60% per week on the outstanding balance until the completion of the loan.

The defendant filed his Written Statement of Defence raising a preliminary point of law that the suit discloses no cause of action and bad in law under the Limitation Act.

He further stated that he cleared his obligation under the loan agreement and prayed that the suit is dismissed with costs.

The plaintiff was represented by Mr. Ssemambo Rashid whereas the defendant was represented by Ms. Farida Ikyimaana.

The parties filed a joint scheduling memorandum wherein they proposed the following issues for determination by this court.

Whether the defendant breached the loan agreement.

Whether the suit is time-barred.

What remedies are available to the parties.

The parties were ordered to file written submissions and accordingly filed the same.

This Court has considered the same in writing this Judgment.

DETERMINATION OF ISSUES

Issue 1

Whether the defendant breached the loan agreement.

Submissions

Counsel for the plaintiff submitted that the defendant was supposed to repay the said loan within eleven weeks from the date when the loan agreement was executed or continue repaying the outstanding monies at an interest rate of 0.60% per week until repayment in full.

The defendant did not repay back the said loan within the agreed timelines and when the plaintiff subsequently presented the defendant’s cheque No. 1349268 drawn on his Crane bank account for payment, the same was dishonoured for lack of sufficient funds.

The defendant did not dispute these material facts neither does he present any evidence of repayment. Counsel, therefore, submitted that this amounted to breach of the loan agreement .

Counsel, therefore, stated that the defendant cannot escape from his obligation to repay the loan at the agreed interest in light of the duly executed loan agreement and asked court finds so.

In a judgement delivered on March 4, 2020 by Justice Musa Ssekana, he ruled that the plaintiff is awarded general damages of UGX 12,000,000.

The plaintiff was also awarded interest at a rate of 8% on the decretal sum from the date of judgment until payment in full.

Full Judgment in a link below..

Court order for arrest of tycoon Obadia Ntebekaine

https://ulii.org/ug/judgment/hc-civil-division-uganda/2020/5