Several officials at Stanbic Bank are in deep trouble after it emerged that they illegally sold property that had been staked at collateral security by their clients for a Shs1 Billion loan.

A complaint seen by this website, drawn by Beatrice Odongo, the director of Macdowel Uganda Ltd, a real estate company, indicate that Stanbic bank officials sold to themselves properties and land in Luzira that belonged to their clients who had secured a loan.

In order to sell the land to themselves, the Stanbic Bank officials used a pseudo company known as Myriad Investments limited to buy the property that had been staked as collateral, then later mortgaged the same to Dfcu bank for billions of shillings.

The complaint from Odongo, which has since been received by the Special Investigations Unit (SIU) in Kireka and the Criminal Investigations Directorate (CID) in Kibuli, indicates that the suspects at Stanbic allegedly sold collateral security to themselves even after the borrowers (Macdowel Uganda Ltd) had repaid the entire loan.

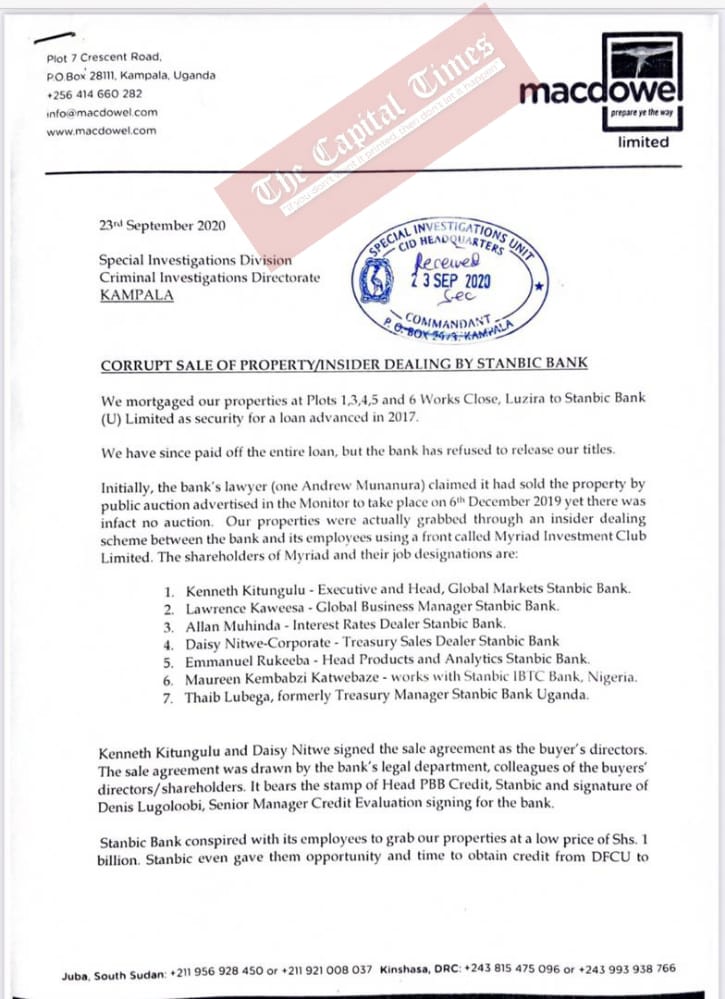

A letter to SIU written by Odongo, one of the company directors, reads in part thus;

“We mortgaged our properties on Plots 1,3,4,5 and 6 Works Close, Luzira to Stanbic Bank (U) Limited as Security for a loan advancement in 2017.

We have since paid off the entire loan, but the bank has refused to release our titles.

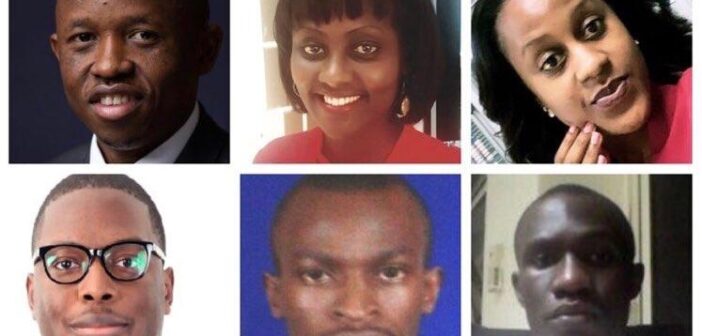

Initially, the Bank’s lawyer one Andrew Munanura, claimed it had sold the property by public auction advertised in the Monitor to take place on 6th December 2019 yet there was not auction. Our Properties were actually grabbed through an insider dealing scheme between the bank and its employees using a front called Myriad Investment Club Limited. The shareholders of Myriad and their job designations are;

1-Kenneth Kitungulu: Executive and Head, Global Markets Stanbic Bank

2-Lawrence Kaweesa: Global Business Manager Stanbic Bank

3-Allan Muhinda: Interest Rates Dealer Stanbic Bank

4- Diasy Nitwe: Corporate Treasury Sales Dealer Stanbic Bank

5- Emmanuel Ruleeba-Head Products and Analytics Stanbic Bank

6- Maureen Kembabazi Katwebaze: Works with Stanbic Bank Nigeria

7- Thaib Lubega, formerly Treasury Manager Stanbic Bank Uganda…”

The letter continues that; “Kenneth Kitungulu and Daisy Nitwe signed the sale agreement as the buyer’s directors. The Sale agreement was drawn by the Bank’s legal department, colleagues of the buyers’ directors/shareholders. It bears the stamp of the Head PBB Credit, Stanbic and signature of Denis Lugolobi, Senior Manager Credit Evaluation signing for the Bank.”

The letter reads in part..

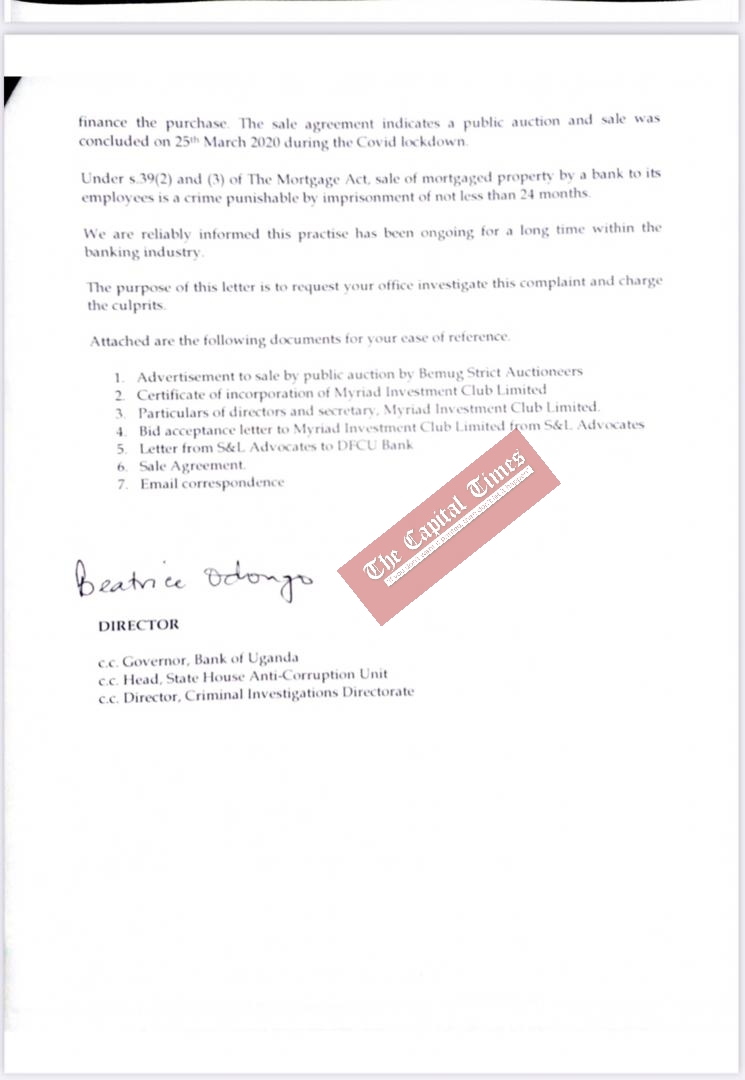

Odongo alleges that; “Stanbic Bank conspired with its employees to grab our property at a low price of Shs1 billion. Stanbic even gave them opportunity and time to obtain credit from DFCU to finance the purchase. The sale agreement indicates a public auction and sale was concluded on 29th March 2020 during the COVID lockdown.

Under S.39 (2) and (3) of The Mortgage Act, sale of mortgaged property by a bank to its employees is a crime punishable by imprisonment of not less than 24 months.

We are reliably informed that this practice has been going on for a long time within the banking industry.

The letter Continues in part

The purpose of this letter is to request you to investigate this complaint and charge the culprits.

However, by the time of filing this article efforts to secure a comment from Stanbic bank officials were futile because they couldn’t be reached through their office lines since it was a weekend.