While Uganda’s banking sector recorded strong financial results for 2021, the Development Finance Company of Uganda (DFCU) Bank continues to reel from its acquisition of Crane Bank in 2017 and the fallout from the Covid-19 pandemic.

The third-largest domestic bank in Uganda in terms of assets recorded a 46% drop in profit to USh9.3bn ($2.6m) in 2021.

“DFCU Bank’s profit was significantly impacted by the loan impairment charge, resulting from the adverse impact of the Covid-19 pandemic,” CEO Mathias Katamba said in a financial statement.

The bank’s non-performing loan (NPL) portfolio increased from USh94bn in 2020 to more than USh274bn in 2021. This is largely due to DFCU’s ownership of local player Crane Bank, which it acquired in 2017 after the central bank put Crane under receivership following discoveries that the grossly mismanaged bank had insufficient capital levels, a shrinking liquidity ratio and surging loan defaults.

While other CEOs have been reluctant to discuss their banks’ performance given the economic slowdown, their financial statements indicate a surge in profits.

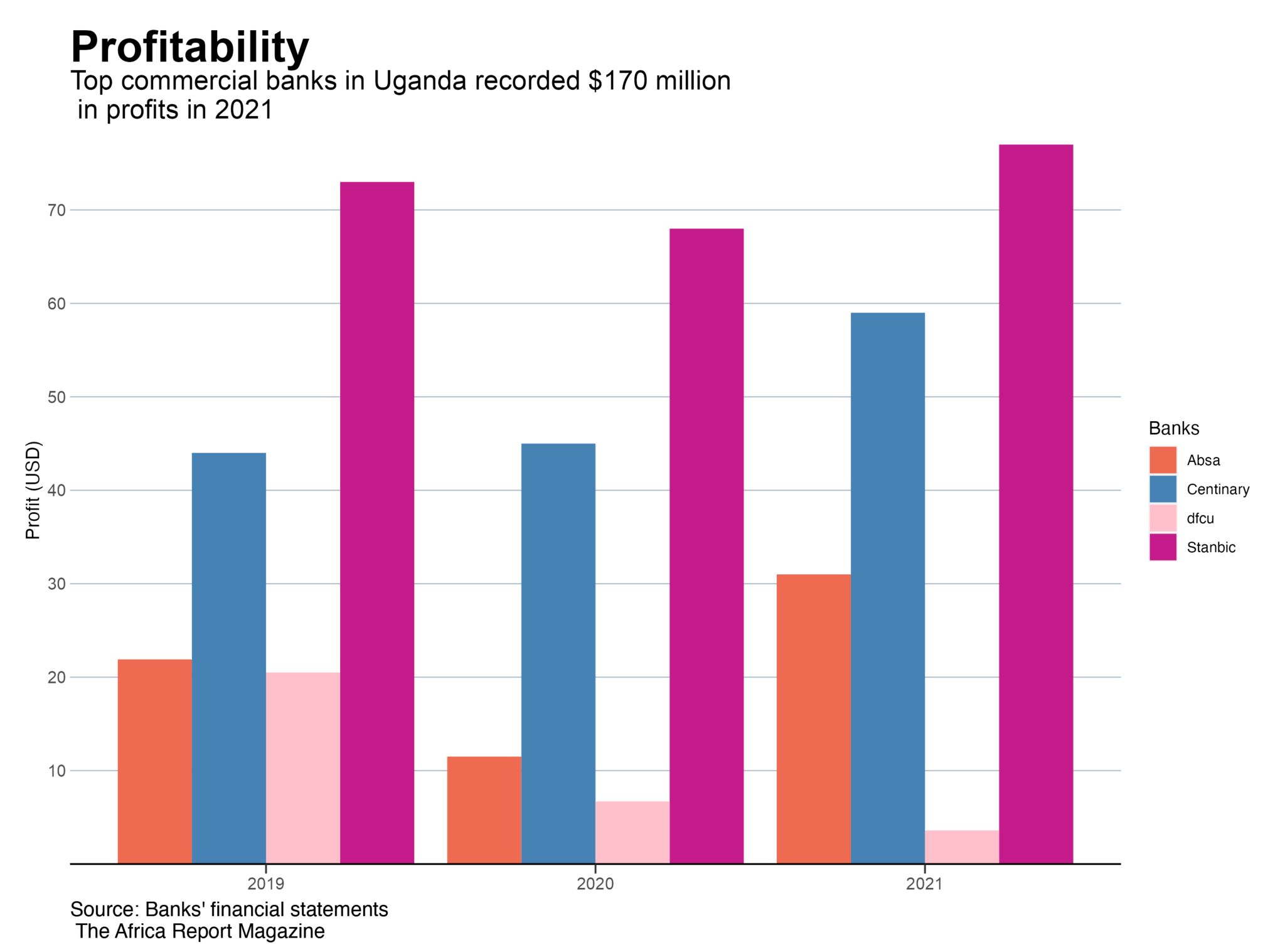

Stanbic Bank Uganda, Absa Bank Uganda and Centenary Bank, which is owned by the Catholic Church, recorded a combined USh597bn in profit after tax for the financial year 2021.

Stanbic Bank announced USh275.4bn in profit, registering an 11% increase from 2020. Centenary Bank’s USh211.5 bn profit in 2021 is a 31% increase from 2020. And Absa’s USh110bn profit after tax was more than a 100% increase from the previous year.

Behind the profit

In a written response to The Africa Report, Stanbic Uganda Holdings Limited CEO Andrew Mashanda said the bank benefitted from being part of South African financial services giant Standard Bank Group, Africa’s biggest lender by assets.

“This heritage, to a large extent, contributed to our sustained strong performance through the pandemic,” Mashanda said.

Moreover, banks devised initiatives to raise capital to support businesses during the pandemic beyond their balance sheets. For instance, Stanbic Bank partnered with the United Nations and other financial institutions in 2020 to launch the Economic Enterprise Restart Fund, Mashanda said.

The initiative raised $100m to lend to small businesses at interest rates between 10% and 12.5%. By the end of 2021, the bank had raised $40m.

Paul Corti, an economist at the Economic Policy Research Center think tank in Kampala, says commercial banks made profits largely from the trade in government treasury bills, with interest rates between 10% and 14%.

“The government is their main customer,” he tells The Africa Report. “During the lockdown, the government borrowed a lot from banks to meet some of the shortfalls in revenue.”

“A lot of government operations had to continue,” Corti adds. “Moreover, salaried workers whose spending dropped during lockdown may have saved higher percentages of their earnings, leaving commercial banks with liquidity to purchase bonds.”

Fred Muhumuza, an economist at Makerere University, says some of the profits that banks registered in 2021 had been deferred from 2020 because of loan restructuring due to the pandemic.

“After easing the lockdown, companies were able to start meeting their obligations,” he says. “That [was]reflected in the performance of this year.”

Uganda’s economy fully reopened in January 2022. Godfrey Senyonjo, a manager at Summit Consulting Limited, a research firm whose focus includes the banking sector, reckons that financial year 2022 results will reveal more about the health of the banking sector given banks will be expecting clients whose loans were restructured to resume servicing them.

No dividend

Despite the banks’ impressive performances, the Bank of Uganda, the country’s central bank, has not allowed banks to pay dividends to their shareholders since March last year due to risks posed by the pandemic.

But some banks have expressed their readiness to start paying dividends again. Stanbic proposed dividends of more than $30m for 2021.

“Banks may have made a lot of money in profits, but I think the central bank is warning them not to get too excited because we see a rough road ahead,” says Corti.

The central bank is in the process of raising the capital requirements for commercial banks.

“Remember, the Bank of Uganda has asked commercial banks to increase their capital adequacy to USh150bn,” says Muhumuza. “That capital will come from the same shareholders. Keeping this money is part of that strategy.”

Though top-tier banks have fewer liquidity challenges because they can access funds from their parent companies, Muhumuza says the central bank will also prevent them from paying dividends because cash-strapped smaller banks may seek short-term money from them when in need.