The Supreme Court in Kampala has dismissed the appeal filed by Bank of Uganda – BoU ( in Crane Bank Receivership) against Businessman Sudhir Ruparelia and Meera Investments Limited as the five-year court battle comes to a grand end.

In a ruling delivered on Friday, February 11, 2022, Supreme Court ruled that BoU reverts Crane Bank to its owner(s) and also directly pay Sudhir all costs incurred during the five-year court battle at all levels.

The grand ruling means the fraudulent sale of Crane Bank has now been ruled as invalid, and Ugandans can now smile again, as this could be the beginning of the restoration of Crane Bank.

Tycoon Sudhir with his lawyers

Background

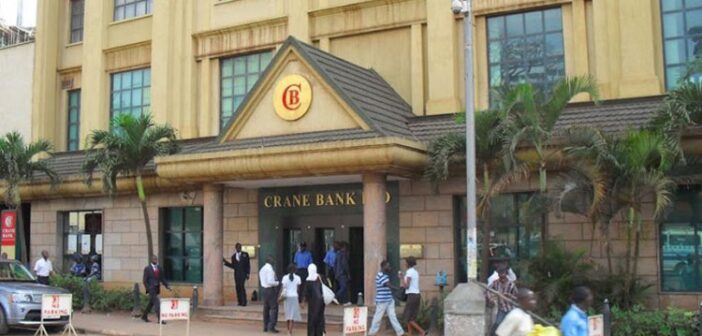

Crane Bank Limited was closed by Bank of Uganda (BoU) on October 20, 2016, after it failed to comply with a capital call on July 1, 2016.

After selling the assets to DFCU, Bank of Uganda filed a suit under Crane Bank in Receivership against Sudhir and Meera Investments seeking to recover over Shs400 billion and 48 land titles.

The suit by Crane Bank was dismissed by High Court with costs to be paid by Bank of Uganda on the ground that a bank under receivership cannot sue, receivership had ended and Crane Bank was a non-citizen company that could not hold freehold titles. Bank of Uganda appealed to the Court of Appeal which unanimously upheld the findings of the High Court. Thereafter, Bank of Uganda appealed the matter to the Supreme Court.

“An interlocutory mandatory injunction doth issue returning the status quo of the 1st respondent to what it was at the time of filing Civil Appeal No.07 of 2020. A declaration doth issue that the 2nd respondent is in contempt of court’s order,” the ruling read.

“The 1st respondent was closed as a financial institution and placed under receivership. Upon closer, it ceased being a financial institution under the Act and it could therefore, not be progressed to liquidation. The 2nd respondent’s act therefore of moving the 1st respondent to liquidation are contrary to the above clear provisions of the law and the same cannot be sanctioned by this court,” reads the ruling.

However, before the hearing of the appeal, Bank of Uganda decided to place Crane Bank into liquidation which materially altered the status of the Bank before the Court. Bank of Uganda’s application to change the status of the appellant from Crane Bank in Receivership to Crane Bank in Liquidation was equally dismissed by the Supreme Court.

After issuing a notice to the public placing Crane Bank into Liquidation, Sudhir through his lawyers, Kampala Associated Advocates filed an Application against Bank of Uganda for a temporary injunction objecting to the move by the Bank of Uganda placing Crane Bank under Liquidation yet there was an appeal before Supreme Court.

Earlier Bank of Uganda withdrew Supreme Court appeal that was contesting the Court of Appeal’s dismissal of the case it filed on behalf of Crane Bank Ltd (in Receivership) versus Sudhir Ruparelia and Meera Investments Ltd.

In a September 15 notice of withdrawal, the Supreme Court Registrar indicated that BoU has decided not to prosecute the appeal and will pay costs.

Justice David Wangutusi of Commercial Court in August 2019 dismissed the first case in which BoU claimed that Sudhir and his Meera Investments fleeced his own Crane Bank (now in receivership) of Shs397 billion.

On Tuesday, June 30, the BoU insisted that receivership does not take away the corporate personality of a company which includes the right to trace and recover assets and the right to sue for those assets.

In the preliminary stages of the appeal, the Supreme Court in August last year, dismissed with costs, an application by lawyers representing BoU in which they sought to substitute the court record from Crane Bank Limited (in receivership) to Crane Bank Ltd (in Liquidation), with the court rejecting the move, as in bad faith and intended to circumvent facts.